The Rational Cloning: Weekly Ideas #67

YAVB on The Offshore Inflection, Old West on Gold Mining Companies, Substacks / Tweets That Make You Go… Hmm 🤔

Welcome to the 67th edition of the Rational Cloning Newsletter (Weekly Ideas Series).

Helping you discover the best ideas of others.

Happy cloning.

Weekly Investment Ideas

(1) YAVB: The Offshore Inflection Parts I & II

If you’ve been following the site / podcast recently, you’ll notice I’ve been hitting you over the head with information on the offshore sector. In particular, you’ll note two (I think excellent) podcasts focused on Tidewater and the offshore space: episode #146 (with Tidewater’s management) and episode #147 (with Judd Arnold).

The reason for discussing them so much is simple: the offshore space appears to be at an inflection point. A combination of high demand and limited potential supply response have created a rising day rate environment. Rates appear to be poised to continue to rise, and even without rising rates the stocks are pretty cheap on current numbers. Management teams and shareholders appear to have gotten discipline on shareholder returns; in the near term, most of cash generation should be going back to shareholders (through dividends or buybacks) or going towards accretive M&A (buying smaller / more distressed players). When you combine cash returns with rising earnings and already cheap stocks…. well, the offshore space could be at an interesting inflection point!

High level thesis

The high level (bull) thesis for all offshore generally rests on three points

It seems like day rates will rise substantially. Offshore drilling demand is returning; as offshore drilling demand rises, asset utilization is tightening and rates are rising.

Rising rates and utilization generally invites a supply response (new boats are built and older rigs are brought back online)… but after a ~decade of underinvestment due to the last boom/bust cycle, there’s no real supply left to come online and it would take years for new builds to come online. And, given how profitable offshore oil is around today’s levels, there’s unlikely to be a demand response either.

Even if I’m wrong on points #1 and #2 above…. offshore is cheap on today’s day rates / earnings levels! This creates a bit of a “heads I win; tails, I win more scenario.” If rates flatline at current levels, the share prices will probably do well. If rates continue to rise (as I believe is likely / as I hopefully showed in points #1 & #2), the stocks will do really well.

One of the experts put it pretty succinctly:

We're in a little bit of a new world we haven't experienced in many, many years. We are seeing that pendulum finally swinging back in favor of the driller. The last time we saw some hints of recovery, we got flat down with COVID and basically pulled the bottom of the market again.

And so now we're seeing a much more structural improvement in the market. We are seeing a material uptick in demand, coupled with just a global lack of supply, there's just not enough drilling rigs right now to kind of meet the long-term outlook of what these operators need. Everyone talks about the fact that we would just have so much, I would say, lack of spare capacity when it comes to oil and gas. We talk about just all this deferred demand that is now kind of pent up and ready to go.

VAL 0.00%↑ DO 0.00%↑ RIG 0.00%↑ TDW 0.00%↑

(2) Old West Investment Management: Q4 / Year-End Letter

Gold and Our Top Gold Mining Companies

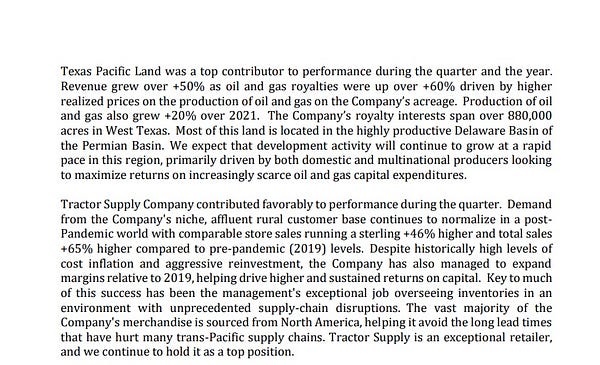

For the past 25 years central banks around the world, led by the U.S. Federal Reserve Bank, have manipulated interest rates (the cost of money) and dramatically increased the supply of money. At the same time, governments around the world have taken on sovereign debt to the point solvency has come into question. At Old West we have for many years seen gold as a stabilizing investment in a world lacking fiscal and monetary discipline. It is for these same reasons cryptocurrencies were developed. However, as gold is truly limited in supply and very expensive to find and produce, thousands of cryptocurrencies sprung up and they became symbolic of the Roaring 2020’s era of free, easy money and rampant speculation. The gold price was flat last year while cryptocurrencies were decimated along with so many other speculative investments. Gold acted as a true store of value.

Rather than invest in physical gold or gold ETF’s where we don’t have much of an edge, we invest in companies that produce the precious metal. That way we can employ our investment process of looking for companies run by great owner/managers, companies with strong balance sheets, track records of profitability and the ability to produce free cash flow. Listed below are the companies we have chosen across our portfolios.

Agnico Eagle Mines, LTD AEM 0.00%↑

Agnico is the third largest gold miner in the world with mines in Canada, Australia, Finland, and Mexico. Although we have long respected the company, we became shareholders when they acquired our portfolio holding, Kirkland Lake Gold. Agnico chairman Sean Boyd is one of the most respected executives in the mining industry. He was appointed CEO in 1998 and was recently appointed Executive Chairman. Boyd is a large shareholder and perfectly fits our owner/manager role. This year the company is projected to make nearly $1 billion in net income on $5.8 billion in revenue with $758 million of free cash flow. Net income has been growing 15% per year for several years. Agnico has a fortress balance sheet with $1.3 billion of long term debt, which is only 2 times EBITDA, and $820 million cash in the bank. The stock trades at $55 per share, which is 26 times earnings with a 2.9% dividend yield.

Barrick Gold Corp GOLD 0.00%↑

Barrick is the second largest gold miner in the world, with operations in the U.S., Canada, Africa, South America and more. Barrick is also a major copper producer. Former Goldman Sachs executive John Thornton took control of the company in 2012 and quickly realized he wanted someone with a mining background to run the company. Mark Bristow, at that time CEO of Randgold, was considered one of the best gold mining executives in the world. Thornton wanted Bristow so badly Barrick bought Randgold in 2018. Bristow who is South African, had extensive experience operating mines throughout Africa, and in fact would fly his own single engine plane to visit mines. He has his PhD in Geology, and he has flourished running Barrick the past five years. Barrick is estimated to have $1.6 billion of net income this year on $11.5 billion of revenue. Net Income has been growing 15% per year. The stock trades at $19.00 per share which is 16 times forward earnings, and the stock has a 3.15% dividend yield. Barrick has a fortress balance sheet with $5.7 billion in cash and $5 billion of long term debt, which is only one time EBITDA.

Novagold Resources Inc. NG 0.00%↑

The previous two mining companies are industry leaders with solid production. The next two companies have no production or revenue but are sitting on huge deposits. We were initially attracted to Novagold because of the track record of success of company chairman and largest shareholder Thomas Kaplan. Kaplan has become a billionaire investing in silver and platinum mines in Bolivia and South Africa. Besides his investing in mining, he owns the world’s largest collection of Rembrandt’s works.

Novagold is co-owner of the Donlin mine in Alaska, along with Barrick Gold. The Donlin mine is on track to be one of the world’s largest gold mines with 39 million ounces of measured and indicated reserves with an average grade of 2.24 grams of gold per ton. A major hurdle is Donlin is located in a remote area of Alaska, and the estimated cost to bring the mine to production is $7.4 billion. That is a huge expense but at today’s gold price the mine has gross revenue potential of $72 billion. Obviously the higher the gold price goes the easier the decision to begin construction. The U.S. government is supportive of the project as are the local Alaska Native stakeholders. Novagold has $120 million of long term debt offset by $142 million of cash. The market cap is $2.2 billion, and the company is burning $11 million of cash per year. It is widely expected that Barrick, who is always looking to buy high quality assets, will purchase Novagold’s 50% interest in the world class Donlin mine.

Seabridge Gold, Inc. SA 0.00%↑

Seabridge was founded by current chairman and CEO Rudi Fronk in 1999. To say Seabridge is Fronk’s life work would be accurate. Fronk, who has two degrees in mining and minerals, is a top shareholder of the company. Seabridge owns the KSM project in northwestern British Colombia. KSM has proven and probable reserves of 47 million ounces of gold and 7 billion pounds of copper. Seabridge also owns attractive deposits in Nevada and Northwest territories of Canada, although much smaller than KSM. The average grade of KSM’s gold deposit is less than one gram per ton, but there is good accessibility to the site, and it is in the safe jurisdiction of mining friendly Canada.

Seabridge’s market cap is C $1.5 billion, they have no long term debt and C $200 million cash. They have been burning C $75 million of cash per year. The company is openly looking to partner with a major miner to develop their properties.

Wesdome Gold Mines (WDO CN)

Some of our best gold investments have been in smaller companies with growing production, as this gives them a way to grow earnings separate from movements in the gold price. Wesdome is a one such producer with two very high grade mines in Canada. Their Eagle River mine in Ontario has a reserve grade of 15 grams per ton, over 10 times the world average. Their Kiena mine in Quebec began producing last month and is expected to ramp up to 100,000 oz per year in 2024.

Minera Alamos (MAI CN)

Minera Alamos is another junior producer with three mines in Mexico ramping up in succession. The first mine, Santana, began production in late 2021 and is now running at 35k oz per year. The second mine, Cerro de Oro, is expected to come online this year and ramp through 2024 to add another 60-70k oz per year, taking them to over 100k oz of annual production. They recently released a preliminary economic assessment for the project showing a robust return profile with low capital costs and a short payback period. Their third mine, La Fortuna, is expected to come online next year and by 2025 produce another 50k oz per year. Combined the three mines are expected to produce 150k oz per year at an all in cost below $800/oz.

Substacks That Make You Go… Hmm 🤔

It is 2023 and of course, I have to return to one of my favourite topics, the investment behaviour of narcissists. Like a dog returning to its vomit, let’s look at a study by Tim Jaeger and Tina Steinorth from the University of Hamburg.

They looked at the investment behaviour of narcissists and people who score highly on the dark triad (narcissism, psychopathy, and Machiavellianism). The interesting feature of their experiment is to ask people to play a game where they get a fixed endowment that they can either invest in a safe asset or in a risky asset. Whatever they have left after they invest in the safe and risky asset they can take home. But here is the trick: the safe asset in their experiment has a lower expected return than the safe asset. For example, if you invest $1 in a risky asset, you have a 10% chance of winning $9 and a 90% chance of winning nothing. Thus, the expected return of the risky asset is $0.9 while the safe asset pays $1 for every $1 invested.

Guess what happened? You got it, narcissists and people scoring high on the dark triad on average invest 2% more of their money in the risky asset. Even though the outcome of the risky investment was completely random, the narcissists believed they would get lucky.

Of course, as we have seen before, narcissists are people who take unreasonable risks or break the rules to get better payoffs. So it’s no surprise to me to see narcissists flock to high-risk investments even if the expected return is worse than a safer alternative.

Over the last couple of months, I have been reading a lot of reports and watching a lot of videos of crypto promoters and people who became billionaires by launching crypto exchanges and crypto hedge funds. All of this was obviously triggered by the spectacular meltdown of FTX and its knock-on effects across the crypto space. But when watching these videos, I could not help but think that most of these people looked like extreme narcissists promoting risky investments that have a lower return than safer alternatives.

I am of course not qualified to diagnose anyone, especially not when watching a video of the person. But it seems likely to me that the crypto space is overpopulated by narcissists, psychopaths, and Machiavellians. And since I have a no-jerks rule in life and try to stay away as far as possible from jerks, that makes me want to stay away from the crypto space even more.

Tweets That Make You Go… Hmm 🤔