The Rational Cloning: Weekly Ideas #63

Goehring & Rozencwajg, Old West Q3 Letter, Substacks/Blogs [Disciplined Systematic Global Macro on Stagflation/Debt Traps] & Tweets That Make You Go… Hmm 🤔

Welcome to the 63rd edition of the Rational Cloning Newsletter (Weekly Ideas Series).

Helping you discover the best ideas of others.

Happy cloning.

Weekly Investment Ideas

(1) Goehring & Rozencwajg Q3 Letter: Why Won’t Energy Companies Drill?

As this chart shows, a tight relationship has historically existed between oil prices and drilling activity. Between 2008 and 2018, the oil price alone explained 70% of the variation in drilling activity. Since 2020 however, this relationship has broken down. The industry should be turning 1,000 rigs; instead, they are stuck stubbornly at 533.

Given these extremely attractive single-well economics, why are the companies not drilling more? Energy analysts throw vague references to capital discipline or labor shortages around.

After studying the issue in depth, we believe oil companies are acting very rationally, even if it seems counterintuitive. By keeping activity low, oil companies are simply responding to the signals sent from their three significant constituencies, all emphatically telling them not to drill. These constituencies are policymakers, investors, and their internal strategy teams.

Oil prices pulled back significantly in Q3, even as crude fundamentals continued to tighten. Worries of a Fed-induced global recession, combined with the measurable effect of China’s COVID-19 lockdown policies, pushed oil prices down. WTI fell almost 25%, while inter- national prices, measured by Brent crude, fell 22%. Global inventories, adjusted for releases from the strategic petroleum reserves (SPR), continue to decline sharply. Not only are SPR releases distorting commercial inventory levels, but they are also masking a severe development: oil demand has already reached and is about to surpass global oil pumping capability.

[Natural Gas] Although the continued growth in gas supply combined with the loss of Freeport LNG demand has pushed out our thesis concerning the convergence of US and international gas prices, we still have great confidence this will occur at some point in 2023. It appears the Marcellus is in the process of rolling over, which is very much in line with our models. Those same models suggest we will see a significant slowdown in the Hayneville’s growth very soon. The Haynesville rig count has doubled since the 2020 COVID-related bottom but has stagnated over the last 10 months. Our neural network suggests that the Hayneville (like the Marcellus) is running out of Tier 1 drilling locations. If this is correct, we should expect drilling activity to stagnate, which seems to be happening right now.

[Coal] Coal prices were once again strong in Q3. Thermal coal prices in the US advanced, and volumes with access to international markets were particularly strong. Illinois Basin coal advanced by 55%, while Central Appalachian thermal coal rallied by almost 25%. Over the past 120 years, every commodity bull market has been led by coal equities, including the bull market experienced during the Great Depression. Once again, coal equities have been the best-performing sector since this commodity bull market began in 2020. History is repeating itself.

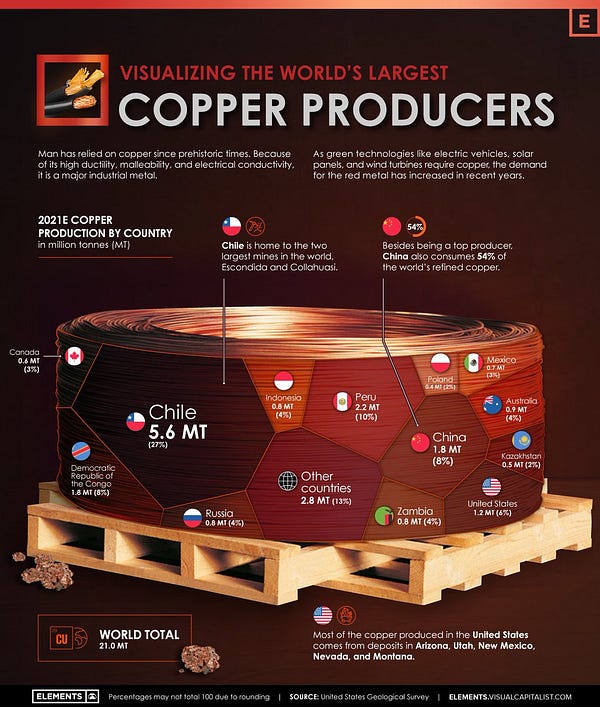

[Copper] We are approaching a dangerous situation in global copper markets—similar to the crisis back at the end of 2005, where copper surged by almost 175% in just six short months… The limited number of world-class projects coming online in the next several years, combined with accelerating depletion problems in the world’s copper mine supply base, means that growth will continue to disappoint as we progress through this decade…. Disappointment in mine supply combined with robust demand growth is about to flip the global copper market into a “structural deficit.” We expect copper prices to surge in 2023 as copper traders finally realize that inventories can no longer fill the gap between demand and supply. The next leg of the copper bull market is about to start.

(2) Old West Q3 2022 Investor Letter

Copper and Filo Mining Corp. (FIL.CN, FLMMF)

Of all the commodities required to build EVs, solar farms, windmills, solar panels, and all things electric, there is no mineral more essential than copper. Old West partner and portfolio manager Brian Laks writes the following:

We have been writing for years about how the push to clean energy will increase demand for many key metals and materials as governments around the world design policies and spend money to usher in a low-carbon future. One of the main ways to achieve this is the widespread shift to electrification, which will greatly increase the need to generate, transmit, store and use electricity. Many of the technologies proposed depend on raw materials that are either in short supply or controlled by a limited number of players and there is probably no metal more integral to electrification than copper, the primary means to conduct electricity.

Renewable energy generation, mostly solar and wind power, and electrification of the global vehicle fleet are two of the major initiatives driving this change. Both require vast amounts of copper, much more than is used in fossil fuel generation and internal combustion engine vehicles. Moving this electricity to where it is needed will also require an expansion and modernization of the electric grid, itself a large consumer of copper. Demand for copper is expected to double over the next 10-15 years driven mostly by these clean energy initiatives. Meeting this demand will be extremely difficult.

The supply challenges are numerous. Existing mines face resource depletion and far fewer meaningful discoveries are being made. Average copper grades have been declining for years making mines less productive and requiring more cost to produce the same amount of metal. Some of the largest producing countries have seen political shifts toward increased taxes and regulations that have hampered investment in new supply. Mining companies have also become more conservative after the last cycle preferring to return cash to shareholders via dividends and buybacks rather than pursue growth, and there is a shortage of skilled labor in the industry as many of the younger generation have pursued careers in finance and tech. Political will and public support can also present a challenge. Anti-mining sentiment is often seen due to environmental concerns even though many climate goals cannot be met without additional mining to provide these necessary metals.

In a world where average copper grades are declining and new discoveries are rare, a large high-grade discovery naturally caught our attention. This is what we saw last year when Filo Mining, a Canadian-listed developer with operations in South America, drilled one of the best copper intercepts the industry had seen in years. With our focus on people we of course looked to see who was involved and were pleased to see the Lundin family own roughly a third of the company. Adolf Lundin was a Swedish entrepreneur who built an oil and mining empire in the 1970s that has grown under the stewardship of his sons and grandsons. The Lundin Group made a name for themselves operating in far-flung regions of the world with incredible success. In an industry where many early-stage projects are run by cash-strapped promoters, being backed by a seasoned group of mining executives with deep pockets is very unique.

The family has a long history of operating in the region, where roughly 40% of the world’s copper is produced. Three generations of Lundins have worked closely with a succession of presidents and other high level country ministers. They acquired the Bajo de la Alumbrera deposit in the early 1990s which became one of the largest copper and gold producing mines of its time. The same local team discovered the Veladero deposit, which is now a producing mine for Barrick Gold. They then picked up a large swath of land in between the region’s two famous copper and gold belts, identifying three early-stage exploration prospects which in 2009 were put into a company called NGEx Resources. As the exploration work yielded discoveries, they eventually decided to spin the individual projects into their own companies. The first was Filo Mining in 2016 which held the Filo del Sol deposit in Argentina. The Filo property was what initially attracted them to the land package, with turquoise-colored rocks visible from space hinting at potential copper mineralization.

The combination of size and grade puts the asset in a rare class among the giants of history. The footprint is truly massive, with a strike length upwards of 5 kilometers, and the mineralization extends to such great depth that the company has had to order special drilling rigs to try and find the bottom of it. The company famously overlays the outline of their project with maps of large cities like New York and London to show its true scale. Their geologists now believe they have identified an entirely new mining district that will support the development of multiple projects. As early entrants to the area, the Lundin Group controls much of the land and recently consolidated that control with the acquisition of Josemaria Resources (another of the earlier spinouts) by Lundin Mining.

Many of the megaprojects in the region require billions of dollars of capital expenditures and are typically operated by joint venture between some of the largest mining companies in the world. Perhaps to that end the company welcomed BHP as a large investor earlier this year. BHP invested C$100 million for 5% of the project and agreed to form an advisory committee to help guide its development. Usually early-stage companies must offer a significant discount to attract large investors, but this transaction was notable in that it was done at a premium to the prevailing share price. It also provided the cash to expand their drill program, targeting a combination of infill drilling to better understand the high grade core of the deposit and step-out drilling to prove its extent. Given what they have discovered so far, we believe it could become one of the largest copper mines in the world.

In our view copper prices will likely have to at least double from here and stay elevated to give the proper signal for additional investment in new supply. We believe structural supply deficits in many commodities will lead to sharply higher prices in the coming years, even if current market conditions suggest otherwise. This disconnect between short term concerns and long term fundamentals presents a compelling opportunity for investors, and we have been actively raising capital to deploy into these areas.

Substacks/Blogs That Make You Go… Hmm 🤔

(1) Disciplined Systematic Global Macro Views: Stagflation and debt traps - The twin problems that are not going away

Nouriel Roubini - "we are facing a stagflation and debt trap."

Professor Roubini is known to many as a Dr Doom, but he has proven to be good at framing the problems we face. The timing may be off on when these traps will bind investors, but there will have to be a day of reckoning.

We have been facing a debt problem since before the GFC. Overall debt was high prior to the GFC. After the GFC, households retrenched, governments did not, and corporations used low rates to lever their balance sheets. This was not an issue when at the zero bound but times are different. In a rising market environment, debt was not an immediate problem. Debt was matched by higher asset values and growing wealth; however, with at best a stall in wealth, balance sheets are deteriorating as debt burdens increase.

Stagflation only makes the debt situation more precarious. Inflation is good for debtors. Think of all the negative debt that was destroyed as rates moved to positive. Yet, new debt and existing debt that must be rolled-over will be at higher rates, and the stagnation in growth diminishes the ability of households and firms to pay-down this higher rate debt. Government debt is not immune to stagflation, but increases in inflation support higher tax revenues.

Of course, these are generalization and that in of itself is a problem. Inflation and low growth create uncertainty and ambiguity of what prices will rise and what will remain stable. Low growth reduces potential new investments. Firms will fail. Firms will not invest, and households will change their spending patterns.

Monetary policy should be restrictive to reduce inflation, but raising rates only enhances the debt problem. Funding costs increase which increase defaults and bankruptcies; however, relieving the debt problem will prolong the inflation problem. A solution to one trap supports the other problem trap. Neither can be solved.

Debt coupled with stagflation create a negative feedback loop. More of either will extend both problems.

(2) Where Are We in the Energy Cycle, A Framework (Spoiler: It's Early Days)

A few key conclusions from the perspective of when structural ROCE upcycles end:

CAPEX: Structural Energy upcycles end AFTER, not before, a multi-year, major increase in CAPEX. Currently we are still closer to the trough of the CAPEX cycle.

REINVESTMENT RATES: Structural Energy upcycles end when industry-wide reinvestment rates are closer to 100%, not at or near all-time lows as is currently the case.

ROCE: Structural Energy upcycles show signs of stress when ROCE begins to underperform a given level of commodity prices. This one admittedly is trickier to gauge as year-to-year ROCE can be volatile driven by short-term oil price movements. Rather, I am focused on the longer-term ROCE trend and looking for the second derivative turn for the worse where the increase in capital intensity (from higher CAPEX and reinvestment rates) starts to negatively impact structural ROCE, especially versus underlying oil price trends (e.g., ROCE falls versus flat or rising oil prices). Currently, CAPEX and reinvestment rates are closer to all-time lows rather than all-time highs. As such, I believe the risk of ROCE underperformance is low at the sector level; company specific risks always exist.

S&P 500 WEIGHT: Structural Energy upcycles typically end when Energy’s S&P weighting is in the low-to-mid teens. Currently, Energy has merely rallied to just over 5% of the S&P 500 from its 2% October 2020 low. While a lot depends on the outlook for other sectors, energy tends to "punch its earnings weight" in the S&P 500 arguing for a 10%+ S&P market cap weighting today.

RUSSEL GROWTH WEIGHT: Structural Energy upcycles end when Energy’s Russell Growth weight is noticeable, which I might characterize as over 10%. Currently, energy is just 2% of Russell Growth, up modestly from the circa 1% it was for much of the 2016-2021 period. To be clear, traditional energy is not a growth sector. Still, during the up portion of the structural cycle, it has historically reached a 10%+ weighting in the Russell Growth Index.

Tweets That Make You Go… Hmm 🤔