The Rational Cloning: Weekly Ideas #65

Volatility Forest Fires, Is Inflation Over?, Substacks / Tweets That Make You Go… Hmm 🤔

Welcome to the 65th edition of the Rational Cloning Newsletter (Weekly Ideas Series).

Helping you discover the best ideas of others.

Happy cloning.

Substacks That Make You Go… Hmm 🤔

(1) Is Inflation Over? Parts 1/2

What does this mean for markets?

As always, this section just reflects my attempts of connecting the dots. Please keep in mind, I am wrong often, markets are humbling, risk management is most important and none of this is investment advice

Having said that, these are my current thoughts:

Oil - This is the one commodity that has not rallied yet, possibly in light of the the US government’s ongoing reserve release. Medium term, my view remains the same, we are in the early innings of an economic slowdown that will likely end in late 2023, and that will weigh on oil. However, as outlined in this post, this slowdown likely won’t occur in a straight line, but rather in yo-yo moves. Sentiment around oil is extremely poor, I expect improved US demand with lower gasoline prices and the market’s attention will soon turn to the end of the SPR release after the midterm elections. I have opened a long in front month futures (CL1) on Wednesday following the CPI data (see here), with a stop at 85$/bbl

Equities - If the conclusions of this post are correct, bond yields likely rise further as oil and commodities rise and the inflation ghost returns. This would weigh on equities, which are very overextended in particular in Tech, with heavy signs of FOMO and declarations of a new bull market. Corporates also likely face a profit margin recession even if the economy stayed strong (the inverse of the 2021 profit boom, e.g. see Google/Microsoft/Facebook complaints about overstaffing). In my view, the risk/reward is very poor at this stage and I remain short

Crypto - The same applies to this sector. Crypto was bid in recent weeks as the inflation ghost was discounted (also the Ethereum merge provided a tailwind narrative). Less inflation makes a return to looser monetary policy more likely. Contrary to popular belief crypto and Bitcoin in particular is not an inflation hedge, it is a monetary debasement hedge. Right now we have inflation, but the Fed contracts monetary policy. There will likely be a moment where loose monetary policy returns, and Crypto sees a lasting rally, but in my view it is not now or near

Finally, as you know, I follow a data-driven approach for my investments, and I share much of this data freely on Twitter

What does this mean for markets?

As always, below is my personal attempt at connecting-the-dots for my own investments. Please keep in mind - I may be totally wrong, nothing is more important than risk management, and none of this is investment advice

As discussed in recent posts, my central scenario remains that of a “hard landing”, which would be bad for risk assets, as long as the Fed remains hawkish (i.e. does not intervene to support markets). Yesterday’s FOMC meeting has not given any reason to believe the Fed would change its hawkish stance soon

As such I continue to remain short risk assets, with a particular focus on Cyclicals. These include Materials (SXPP), where I believe with 20% vacancy rates a further inflation of the Chinese property bubble seems unlikely, thought this is what the market prices. Further, Europe (DAX) as well as US Industrials (INDU) and US Regional Banks (KRE) which suffer from deposits outflows in light of 4%+ money market rates, and where credit losses should pile up in the coming months

While there was a chance for a “Santa Rally” in case of a more lenient Fed, for which reason I had reduced exposure into the meeting, this seems less likely now. Either way, important catalysts to the downside are under way, with important economic releases early January (e.g. ISM Manufacturing PMI on January 4th) as well as pre-announcements for a likely weak Q4 earnings season, also from then onwards

In my view, the big picture remains simple:

As outlined in today’s post, we likely enter a period of weak demand, as consumer savings run out

Following 14 years of QE and immense excesses over Covid-19, there is a record amount of debt, especially government and corporate

Historically, at this stage in the cycle, the Fed either cut rates or started QE. Right now, it is still raising rates and conducting QT

After a strong rally, especially equities are extended and valuations very high

In my view, this is a bad context for risk assets. There will likely be more credit events and defaults, and with it likely more forced asset selling, as we have just seen with Elon Musk’s huge Tesla placement. It is likely prudent to stay cautious, with an emphasis on USD cash that currently pays 4.3% interest, to then have the dry powder to go all-in when the bear markets nears its end, which in my view will be in the first half of 2023

(2) Volatility forest fires yet to burn

The below is an excerpt from our Nov 22nd report to VP clients.

One of the interesting features of this year’s bear market has been the strong performance of short AND long vol strategies.

Short vol strategies have worked this year as the VIX curve has mostly been in contango (positive roll effect from selling longer-term VIX futures and buying shorter-term futures) and VIX has not spiked above 36.

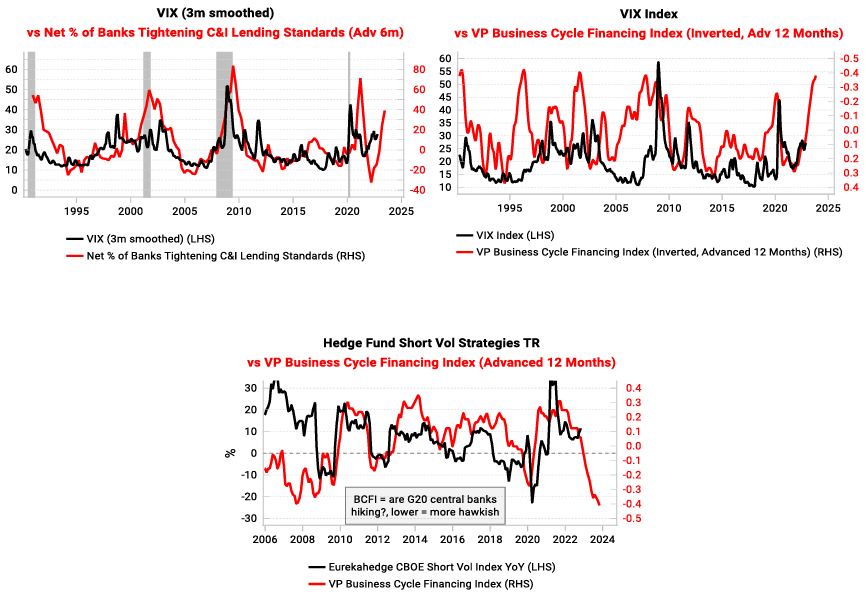

We think forest fires offer a great analogy for thinking about volatility. Structural drivers of volatility tell us when the forest is most at risk and tactical drivers of volatility provide the sparks that light the fire (see our previous blog post: Understanding Volatility).

The credit and liquidity cycles offer long leads on volatility. Extreme abundance of liquidity (e.g. 2020-21) lead to surges in credit and debt. As liquidity tightens and credit cycles mature, much of the previously extended credit cannot be repaid, leading to charge-offs and bankruptcies and spikes in volatility.

There is clear evidence the credit cycle has turned sharply lower in the US (left-hand chart; red line higher = banks are tightening lending standards). Liquidity indicators confirm a much higher chance of a vol spike (right-hand chart). Short vol strategies remain very vulnerable in this environment.

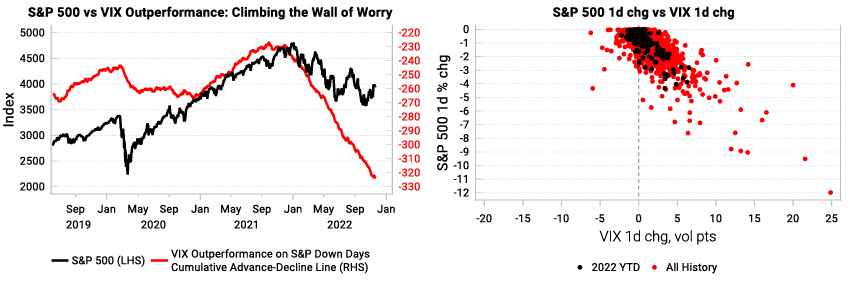

Tactical drivers of volatility have not aligned with structural drivers this year. The VIX index has consistently underperformed the S&P (left-hand chart shows our cumulative advance-decline of VIX outperformance vs the S&P daily move).

This is not just a US phenomenon, the VSTOXX index has also underperformed on down days this year.

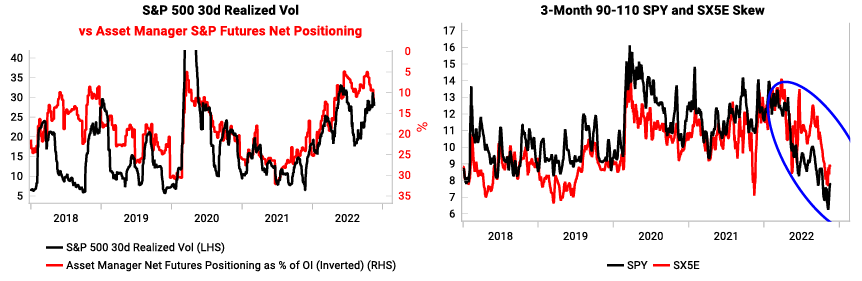

Depressed equity positioning is one of the key drivers of vol underperformance. Vol target funds aim to maintain a stable rate of realized volatility by trading equity futures. When realized vol shifts lower, these funds lever up equity exposure and buy index skew. But this year has seen these funds reduce equity positioning (red line inverted), as index skew collapses.

This is largely why S&P put spreads have been inefficient hedges this year.

Tweets That Make You Go… Hmm 🤔