The Rational Cloning: Weekly Ideas #66

Best of Credit Bubble Stocks (2022), VP Blog: Age of Scarcity Part 1, Substacks / Tweets That Make You Go… Hmm 🤔

Welcome to the 66th edition of the Rational Cloning Newsletter (Weekly Ideas Series).

Helping you discover the best ideas of others.

Happy cloning.

Weekly Investment Ideas

(1) Best of Credit Bubble Stocks (CBS) - 2022

Rethinking Inflation: "'Inflation or deflation?' is a political question; you can't determine the outcome from modeling of macroeconomic variables without reference to what the people who control the central bank want."

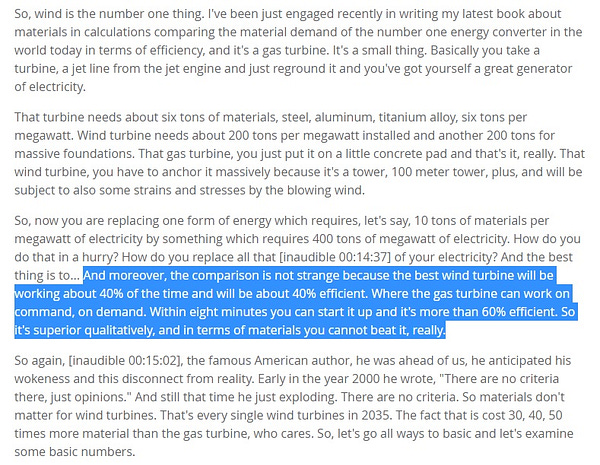

"The Hard Math of Minerals" - Why the "Energy Transition" Won't Happen: "Canadian oil majors, royalty owners, and hydrocarbon pipelines are all priced as though disruption - actual replacement by wind and solar and electric vehicles - is going to happen in the next five years or so. But simple back of envelope economic calculations based on physics and energy density tell us that replacing fossil fuels (again, 80% of current world energy consumption) with those energy sources, the so-called 'energy transition,' is impossible. That means that the world is seriously under-investing in hydrocarbon production and traditional energy infrastructure, and over-investing in electric vehicles (TSLA) and in wind and solar boondoggles that will collapse the way the previous iteration (e.g. Suntech Power, Evergreen Solar, A123 Systems) did a decade ago."

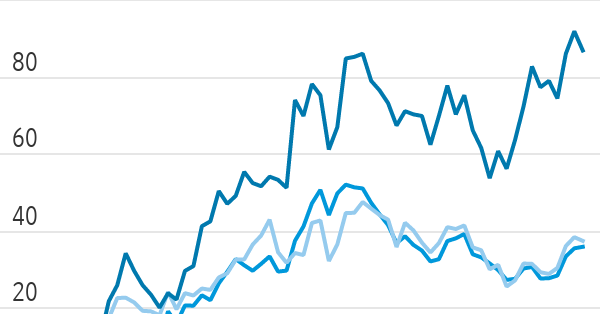

Goehring & Rozencwajg: "The Distortions of Cheap Energy": "We have mentioned in the past that we have settled on long-life Canadian oil majors and royalty trusts for our energy investments. Some key concerns that informed this: Avoiding (or benefiting) from escalating production costs, which other E&Ps will have. Avoiding reinvestment risk / principal agent conflict with managements, which seems to be the key reason that the E&P sector fails to build value over time. Oil sands are almost royalty-like, in the sense that (a) the capital costs are front loaded, unlike drilling wells, so they should benefit more from inflation than an E&P and (b) they have decades of sands to mine, so you avoid the forced reinvestment at inopportune times."

Is Dorchester Minerals LP Just a Depleting Asset?: "If Dorchester were just a depleting asset, their sales of oil would result in a finite pool of oil shrinking over time. Since the reserves are growing, it means one or both of two things: the proved reserve metric understates the total amount of ultimately recoverable oil in their land, and/or the acquisition of new land using partnership units is having an accretive effect. But either way, the partnership was not just a 'depleting asset' over the past 15 years."

Morning Earnings: Philip Morris International Inc.: "You pay a premium to Altria and British American for great capital allocation, strength in the Marlboro cigarette business, geographic (and regulatory) diversification, and a growth business in smoke-free alternatives. Thought experiment: if you had to pick two securities to leave to your heirs, might they be Philip Morris and Dorchester Minerals?"

Review of Numbers Don't Lie: 71 Stories to Help Us Understand the Modern World by Vaclav Smil: "A great thing about Smil is that he (rightly) considers smartphones and advertising website businesses (like Facebook) to be completely irrelevant compared with more important technologies like steel, electricity, nitrogen fertilizers, and shipping. He says that we can't replace fossil fuels without major economic and social dislocations. We know that Bill Gates reads everything he writes. Has Bill Gates decided that it's worth imposing some economic and social dislocations on the rest of us in order to reduce carbon emissions? Why would someone who is so concerned about rising carbon dioxide levels (and who knows that there is no way to having rising standards of living without rising carbon dioxide levels) also be so concerned with research into pandemics and biological warfare?"

Review of Fossil Future: Why Global Human Flourishing Requires More Oil, Coal, and Natural Gas--Not Less: "As investors what we care about is: are there are more cost-effective ways to provide the energy that humanity needs - about 100 quadrillion BTUs annually in the U.S. - than the fossil fuels we own? Are alternative energy technologies capable of displacing (and leaving 'stranded') our fossil fuels in the near term? Are battery electric vehicles going to be more economical than ICE powered vehicles? Are wind and solar going to be more economical than coal and natural gas? These are technological questions that depend on physics and chemistry, and they are better addressed by writers like Tom Murphy and Vaclav Smil."

Tomorrow's Energy: Hydrogen, Fuel Cells, and the Prospects for a Cleaner Planet by Peter Hoffmann: "The cost of 'renewable' energy technologies like solar, wind, and batteries was falling because we were in a commodity bear market (2008-2020) with the necessary materials being sold below the long run sustaining cost of production. If someone had actually disrupted gasoline/ICE vehicles, or fossil fuels, you would have heard about it by now. There is nothing better than petroleum for transportation fuel. (Nuclear is better than fossil fuels for generating electricity, but that doesn't work for transportation without better batteries.) That means we are probably going to be using it for a long time - probably until it is exhausted. Royalty trusts are yielding 15% and the EV/FCF on Canadian oil producers is north of 20% while Biden is dumping a million barrels a day oil from the SPR and the industry is drawing down its backlog of drilled uncompleted wells. This is perhaps the greatest mispricing we have seen since we started this blog."

Review of The Great Demographic Reversal: Ageing Societies, Waning Inequality, and an Inflation Revival: "Banks own tons of treasuries, and their balance sheets have been devastated by the increase in the ten year bond yield, something that is being chronicled over at Oddball Stocks. Higher interest rates also mean that the interest on the $31 trillion federal debt grows, which is a positive feedback loop since the debt is not being serviced. And high interest rates choke the economy, which is unpleasant and also lowers tax revenue - worsening the debt spiral - and causes banks' loans to default. So it has seemed clear to us that printing money to buy bonds (yield curve control, capping bond yields) is the path of least resistance, 'kick the can' approach that the regime will choose."

Substacks That Make You Go… Hmm 🤔

(1) The Age of Scarcity Part 1: The inflationary impact of government spending

In the coming decade governments will no longer hide behind the “invisible” hand of the market. They will be forced to make explicit choices on how society allocates resources. We think portfolios need to be positioned for structurally higher inflation. This will be a 3-part series based on the insights from our thematic report sent to VP clients in November 2022.

Since the 1980s, free market orthodoxy had effectively “de-politicized” economic policy. Governments were shielded from making decisions on resource allocation, leaving it up to the market’s “invisible hand”.

Today, the pendulum has swung back, with calls for the “political management of the economy” as we move towards an age of top-down government intervention.

The “Age of Abundance” since 1980 (with cheap credit, cheap labor and cheap commodities) is ending.

On a 3+ year structural outlook, investors should focus on:

Real assets: useful upstream commodities in short supply, i.e. energy

Real estate and housing

Capex supercycle beneficiaries (part 3)

Higher “new normal” level of yields for nominal bonds

Gold and crypto are more complicated. They benefit from negative real rates as governments monetize their debt in a managed way. However, without obvious intrinsic value, the volatility will be very high (gold crashed 40%+ during the inflationary 1970s).

Tweets That Make You Go… Hmm 🤔

happy new year, friend.