Welcome to the 64th edition of the Rational Cloning Newsletter (Weekly Ideas Series).

Helping you discover the best ideas of others.

Happy cloning.

Substacks That Make You Go… Hmm 🤔

Tweets That Make You Go… Hmm 🤔

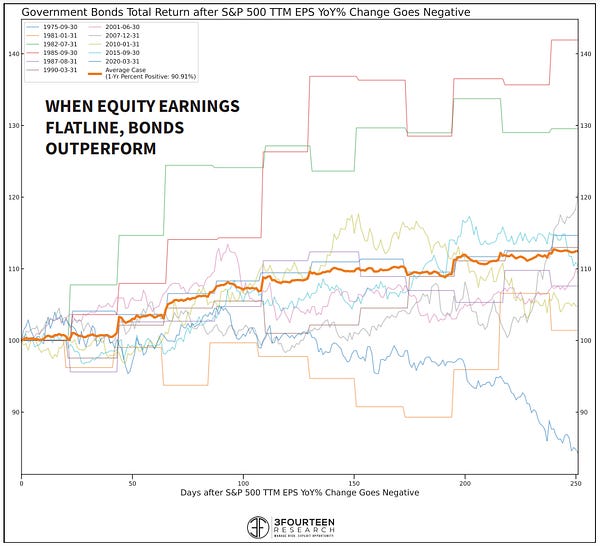

Multiple regimes are lining up for bonds in 2023.

If S&P earnings contract, bonds should provide a cushion.

Year following earnings contractions, LT Treasuries are positive 10 of 11 previous cases...returning 12% on average.

Only negative case was COVID earnings "flash crash."

Investors are frantically pulling money out of real estate.

Nontraded REITs saw $3.7 billion in redemptions in Q3.

This is a 12x increase over last year.

Starwood Real Estate Income Trust, similar to $BREIT, a nontraded real estate investment trust, is curbing redemptions after investor withdrawal requests exceeded the REIT’s monthly limit in November.

Painful period for clients of nontraded real estate investment trusts.

James Bullock's latest is great:

-investors fail to identify or at least appreciate the most durable of moats

-the Lindy effect

-investors overvalue promise but put no premium on longevity

-Pepsi's 2021 dividend was ~3x its 1980 market value

lindselltrain.com/application/fi…

The rising power of Teams at Microsoft:

"Going into the pandemic...Office 365. That was the main source of value for us. During the pandemic, that changed in a pretty significant way...[Teams is] becoming a major force in commercial software"

$MSFT

Buffett: "All the journalists that have covered Berkshire over 25 years – they come in, they write about Berkshire and look at the facts, but virtually none of them bought the stock. They’ve done all this work, they’re trying to figure out what I’m thinking and what we’re doing."