The Rational Cloning: Weekly Ideas #49

Kuppy on "The Pause", Substacks (The Koala on Lithium) & Tweets That Make You Go… Hmm 🤔 (Michael Kao on Asian-Contagion 2.0, Power Prices in Europe, and more)

Welcome to the 49th edition of the Rational Cloning Newsletter (Weekly Ideas Series).

Helping you discover the best ideas of others.

Happy cloning.

Weekly Investment Ideas

(1) Kuppy on “The Pause…”

I have frequently described “Project Zimbabwe” as a highly inflationary cycle where both fiscal and monetary stimulus go into insanity mode. While I sincerely hope we don’t go hyperinflationary like Zimbabwe, I certainly think we see an elongated period of substantial and debilitating inflation.

The history of the Federal Reserve for the past few decades is that they overstimulate, then try to reign things in; until they break something, leading them to overstimulate again. Once on the hamster wheel, their only choice is to spin it faster. Meanwhile, the fiscal side is already preparing for another trillion in stimulus to supposedly fight inflation—they clearly have even less stomach for a pullback.

It is clear that they prefer inflation to another lost decade of patching up the financial system like in the 2010’s. Oddly, investors think that the Fed will take rates to a level where it detonates things… Given the level of debt in the system, tightening too much could very well blow up the US as well. These things cascade fast—markets cannot even get close to stall-speed. All the bluster is for show—these guys know that the Fed is Fuct—they’ll go back to money printing at the first sign of panic.

Plenty of speculators were over-levered, mostly in Ponzis. They got shredded for staying too long in last-cycle’s rolling bubble. They missed their chance to pivot into the next rolling bubble… Energy is one of the few asset classes that is still up on the year—it’s giving you a clear message about what’s coming—it sure feels like energy is going to be the next rolling bubble. Miss it at your own peril.

Long-dated call options are far too cheap. This is where I need to be pressing it and with far more capital on this pullback. These options give me cheap exposure to what’s about to happen. The skew is all wrong. When JPOW declares that The Pause is in effect, the market will positively explode to the upside and the IV will spike as the skew shifts. The next up-surge will make the last cycle’s trading in monkey JPEGs look tame—except this time I expect it will be an energy bubble.

Substacks That Make You Go… Hmm 🤔

(1) The Koala: Lithium Today is Iron Ore Twenty Years Ago

So simple question – where is the feed for all these massive new lithium hydroxide capabilities going to come from? Now to make it even more interesting, what if western world lithium ion batteries need to contain western content like talked about for EV credits in the recent Inflation Reduction Act in the United States?

To be clear, this does not mean the lithium prices we see today are sustainable, that is not the koala’s call, but it seems crazy to say long term lithium prices are not materially higher then brokers are using today since we have to incentivize so much incremental supply and the quality projects don’t seem to be there in the pipeline.

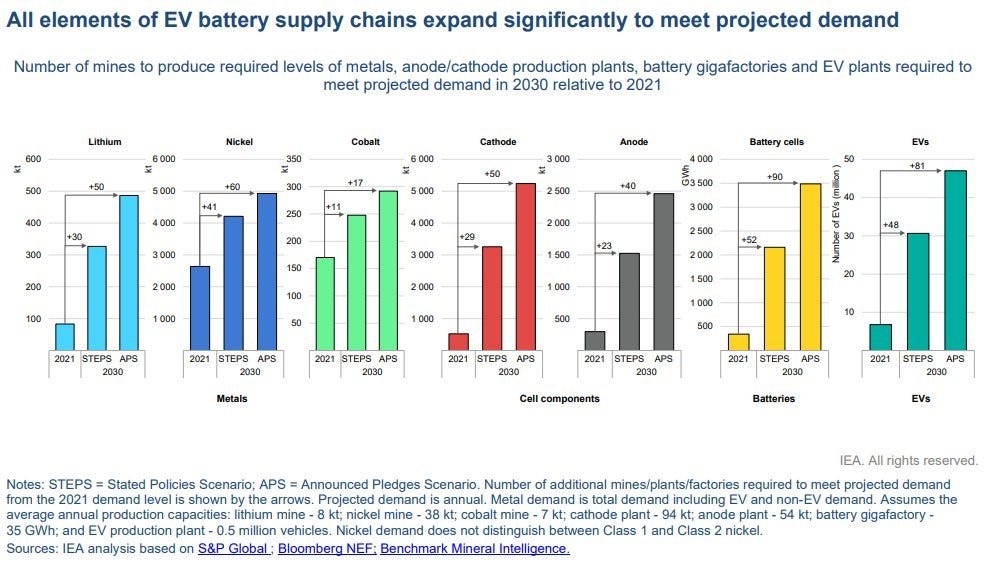

But bottom line, when I took a step back to think about this over the last few months, as we think about what is happening in battery metals, and we see all these fancy charts get shared from the IEA and other sources like S&P Global, Bloomberg, and Benchmark showing how many new mines we are going to need, the koala had this metaphor epiphany.

The simple mental framework for this is the rise of China in the 2000s building steel mills not quite sure where the iron units are going to come from for all of it. We have seen this movie before, it’s just a different lead actor on the periodic table.

So where is the S11D, Solomon, Christmas Creek, Bloom Lake, Roy Hill, Minas Rio, or even just the South Flank or Hope Downs? Because we’re going to need it.

Tweets That Make You Go… Hmm 🤔

Guess we follow mostly the same people :D