The Rational Cloning: Weekly Ideas #47

Credit Bubble on Horizon Kinetics' 2021 Compendium Highlights; Substacks (Nat Stewart on SIRE; Philo on Midwit Trap) & Tweets That Make You Go… Hmm 🤔

Welcome to the 47th edition of the Rational Cloning Newsletter (Weekly Ideas Series).

Helping you discover the best ideas of others.

Happy cloning.

Weekly Investment Ideas

(1) Credit Bubble Stocks: Highlights From Horizon Kinetics' "Compendium Compilation (Eighth Volume)” (2021)

If the supply of goods and services aren't increasing at the rate of the money supply, you have to ask why? One answer is that there are key commodities for which the production level can't increase very much. Not because it's technically impossible to do, but because the extractive industries are under a constraint. The constraint is they cannot increase, in any measurable way, the emission of carbon dioxide and other greenhouse gases. The goal for almost all of them, which you can now read about in their annual reports, is to decrease emissions by about 3% year. The only way to accomplish that is to not expand production in any meaningful way. Yet, the world population increases by about 80 million people a year, and they're going to need those products - whether it's silicon, soda ash, oil and natural gas, or lithium - whatever it is that's going to be used, there are more people needing more of it.

The prevailing belief is that the world can eliminate much of its hydrocarbon usage. We're going to find out if that proposition is true or false in the next several years. For myself, I believe that proposition is false. I don't necessarily believe that the most wonderful thing in the world is hydrocarbons, and I also believe that if there were a viable alternative to it, it should be undertaken. I just don't think there is a viable alternative as a practical engineering proposition.

At some point, the bondholders do experience the sensation of debasement And when they do, they'll refuse to buy bonds anymore. Then you're in a major financial crisis. The central banks will have no alternative but to buy those bonds, otherwise they're going to create a massive problem. If the central banks have to support the bond market at the current yield levels, you're going to have incredibly serious inflation, much more serious than we have right now. And that's what, I think, is ultimately what we're coming to.

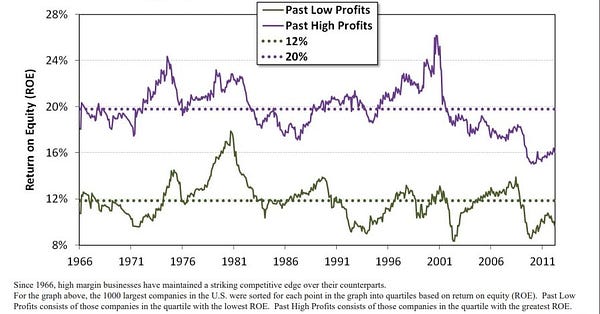

The production of ordinary commodities in common use... requires enormous amounts of capital. The return on capital is generally rather low and quite cyclical. Moreover, the periods of low return on capital can persist for many years. It should not be surprising to learn, consequently, that investment capital gravitates towards the high return businesses and away from the low return cyclical businesses. If such trends persist, some types of commodity production will at some point become inadequate to meet demand. The result in a free-market society is allocation of scarce resources via price adjustment, a phenomenon otherwise known as inflation. Inflation raises the return on capital for commodities, but the return still remains low even though it is elevated relative to the prior period, and it still remains cyclical.

If you're really interested in the study of inflation, the investment challenge is not to simply protect yourself against the ravages of inflation; it is to benefit from inflation, to improve your position via inflation. To merely keep pace with inflation doesn't change anything.

The following is a list of 20 publicly traded royalty companies. A few might be left out, but 20 is more or less the total number that exist in the world. FNV 0.00%↑ WPM 0.00%↑ SAND 0.00%↑ RGLD 0.00%↑ OR 0.00%↑ MMX 0.00%↑ MTA 0.00%↑ $LBRMF $ATBYF TPL 0.00%↑ $PREKF VNOM 0.00%↑ MSB 0.00%↑ MNRL 0.00%↑ RPRX 0.00%↑ DMLP 0.00%↑ $FRU.TO $ALS.TO $DRR.AU SBR 0.00%↑ .

The consensus view right now is that the governments of the world will, collectively, eventually eliminate tobacco as a retail consumer product. Thus far, they haven't been able to do it. In fact, in some respects, the industry is enjoying a type of renaissance. If there is legitimacy to that observation, if this renaissance persists, then the tobacco companies are not going to continue to trade at the present low multiples. When that happens, assuming it does happen, the upward valuation rerating of the companies will also happen on a lower number of shares, because most of the tobacco companies are buying back their own stock. If the rerating really does happen, then it will involve a lower number of shares, which would create a quite a substantial rate of return.

The challenge for the pharmaceuticals companies is that, in order for a large market capitalization firm to grow at a sufficiently elevated rate, it is necessary to invent new drugs that either cure or treat, but preferably only treat, widespread ailments. In the case of a decisive preventative or a cure, such as a one-time childhood vaccination for diptheria or polio, or a course of antibiotics for an infection, the revenue opportunities are curtailed by the success of the treatment. In order to secure an ongoing stream of revenue of the type that can qualify as a blockbuster drug, what is required is a chronic but non-fatal disease that can be controlled for many years, but not cured.

Substacks That Make You Go… Hmm 🤔

(1) SIRE situation fits a winning fact pattern [SIRE 0.00%↑]

On July 6th, Sisecam Chemicals Resources proposed a buyout of Sisecam Resources L.P. for $17.90/unit

Last November, Sisecam Chemicals purchased its current stake in the business for an implied price of $33.44/unit

This enormous value discrepancy is unlikely to fly with the Conflicts Committee - the independent board members charged with acting in public unitholders interest

This is one of the most undervalued “initial price” MLP buyout efforts I have seen

Recent MLP buyouts have provided decent bumps to those who purchased prior to a formal offer with very favorable risk/reward

If no deal is made, we are left with a world class asset currently enjoying bullish market conditions while benefiting from a hefty yield - not a bad situation

The “MLP buyout” opportunity exists for a few reasons

MLP’s are stranded without much of an investor base

Many investors are scared by memories of being burned by the General Partner

MLP securities have zero (or even negative) utility to their General Partners

Given the above, it makes all the sense in the world for General Partners to buy out their L.P. unitholders

Framing risk/reward

Given the above, I think SIRE can be safely purchased at a premium to the proposal price of $17.90/unit - I see the probability that this price “holds” as being very unlikely.

A more probable downside case would be a “weak” bump of say 20% - in other words, a price still far below the intrinsic value of the business and absurdly below the $33.44 the GP paid last year.

In this case, a “breakeven” buy level would be around $22.50/unit, given the unitholders receive $1/unit in distributions prior to close ($17.9 * 1.2 + $1) This price would create 23% upside to the $27.72 buyout base upside, or 38% upside to a “closer to equitable” $30 buyout price. In either case the IRR is very strong for a limited risk, finite time horizon position.

(2) The Midwit Trap: Why are we so dismissive of simple solutions?

According to Know Your Meme, “midwit” is a derogatory term used to describe someone of average intelligence who mistakenly believes they are among the intellectual elite. The Midwit Meme is usually used to defend a position that seems too simple and unsophisticated to be correct.

The idea behind the Midwit Meme is that sometimes the correct solution to a complicated problem turns out to be very simple. In this scenario, the genius and the simpleton will both end up with the right answer for very different reasons: the genius will fully understand and correctly solve the problem, while the simpleton will blunder into the right answer for the wrong reasons. (The simpleton always picks the simple answer whether it is right or wrong, an approach that will sometimes lead to the right answer by chance).

We assume that a complex solution is likely to be the product of more sophisticated and nuanced reasoning than a simple solution, and thus more likely to be correct. This is far from true. In fact, in all of our examples, the complex solution is the result of less sophisticated and nuanced reasoning than the simple solution.

In Fooled by Randomness, Nassim Nicholas Taleb introduced the idea of Mediocristan and Extremistan. In Mediocristan, everything is normally distributed, and extreme events rarely happen. In Extremistan, there is an exponential distribution and extreme events happen much more often.

The Midwit Trap is to some extent just an application of Extremistan. The effectiveness of a simple solution depends on having a problem where one cause is responsible for most or all of the negative consequences. This is likely to be the case where there is a power law distribution or strict dependencies, but not so much elsewhere. We are used to solving problems in Mediocristan, where we usually cannot achieve a significant outcome with “one simple trick!” and so we are dismissive of simple solutions or simple explanations.

The Midwit Meme turns out to have a useful purpose, to remind us in a concise, memorable way that we cannot accept complicated solutions or explanations only because they feel smarter than a simple solution.

Tweets That Make You Go… Hmm 🤔