The Rational Cloning: Weekly Ideas #48

Smead Capital on Oil & Gas, Substacks (Nat Stewart on Atlas) & Tweets That Make You Go… Hmm 🤔

Welcome to the 48th edition of the Rational Cloning Newsletter (Weekly Ideas Series).

Helping you discover the best ideas of others.

Happy cloning.

Weekly Investment Ideas

(1) Smead Capital: Suffering Slings and Arrows

A review of how we got here is necessary. First, we saw this 250-year price chart that showed that the next commodity bull market was going to be a doozy:

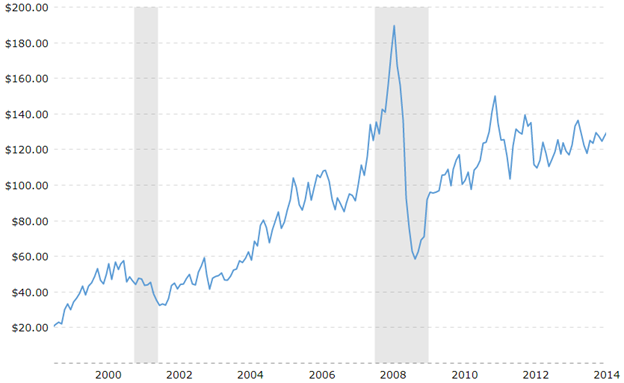

Second, we were reminded of the length of prior oil bull markets in the 1970s and from 1999 through 2014:

Third, we knew how much had been invested in ESG funds and ETFs versus oil and gas funds and ETFs in 2019-2021:

With these historical underpinnings, we felt compelled to invest in the oil and gas business in 2020-2022.

Therefore, why are we willing to “take arms against a sea of troubles” in a major correction in the oil price and in oil stock prices? The answer lies in the evidence. Obviously, we are keeping very good company in the oil patch. Peter Lynch, Sam Zell, Jerry Jones, Harold Hamm and Warren Buffett/Charlie Munger have backed up the truck over the last three years in the oil and gas patch. As we have said many times, “The only thing better than being smart is knowing who is!” As Munger says, “Plagiarism is completely acceptable in the investment business.”

Lastly, the sheer force of the returns these oil companies could make with prices exceeding $80 per barrel for a decade makes Warren Buffett’s mouth water. After all, the free cash flow numbers are making debt repayment last for a short time and copious dividends and stock buybacks last much longer. We will “take arms against the sea of troubles” in oil price volatility and the continuation of the bear market in the S&P 500 Index.

Substacks That Make You Go… Hmm 🤔

(1) Nat Stewart - Stock Picking Newsletter: The Atlas Corp Special Situation

Situation:

A majority shareholder group has made a non-binding offer to acquire the remaining outstanding shares of Atlas Corp ATCO 0.00%↑ for $14.45/share. The full statement can be found here.

Yesterday, Atlas Corp shareholder Charles Frischer made a compelling case that the initial offer severely undervalues the company via a letter to the special committee evaluating the transaction which was made public yesterday.

Given the above, it seems probable that at a minimum we will see some type of bump to the initial proposal.

My take

Playing this for a moderate bump looks like a reasonable trade - particularly when the share price is under the initial proposal level of $14.45.

Tweets That Make You Go… Hmm 🤔