The Rational Cloning: Weekly Ideas #46

Clark Street Value on WideOpenWest; Substacks [ft. The Diff, Value Situations] and Tweets That Make You Go… Hmm 🤔

Welcome to the 46th edition of the Rational Cloning Newsletter (Weekly Ideas Series).

Helping you discover the best ideas of others.

Happy cloning.

Weekly Investment Ideas

(1) Clark Street Value: WideOpenWest (Cable Overbuilder Rumored for Sale) [July 15, 2022]

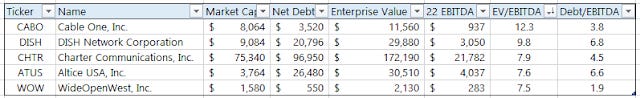

WideOpenWest WOW 0.00%↑ ($1.6B market cap) is a cable/broadband overbuilder primarily focused on secondary and tertiary markets in the southeast that trades for 7.5x EBITDA, while it sold assets last year for 10-11x EBITDA (here and here). WOW is rumored to be in a late stage process to sell itself with both Morgan Stanley Infrastructure Partners and Global Infrastructure Partners reported as interested bidders (worth noting that the two asset sales were to strategic buyers, both of these firms would be financial buyers). Fully acknowledge that we're not in the same 2021 M&A environment, but the PE bid and financing are still there for digital infrastructure like businesses. Even a takeout at a 9.5x EBITDA multiple would equate to $24.30/share or 35% higher than today's $18.00/share price. After the asset sales, WOW is currently under levered at 1.9x net debt/EBITDA (a PE buyer would likely lever a cable company up to 5-6x); taking WOW out at a cheapish price with a relatively small equity check due to the ability to lever it up further, this deal would likely be a home run for the buyer.

A bit more about the business, as an overbuilder, WOW is the "challenger" cable provider that enters established markets which typically already included either Comcast's (CMCSA) Xfinity brand or Charter's (CHTR) Spectrum brand (which I'm long via LBRDK). In order to convince customers to switch from an incumbent provider, WOW has to offer some combination of faster speeds, lower prices and better customer service. Additionally, WOW lacks the scale and purchasing power of a Comcast or Charter when it comes to negotiating with content providers, further squeezing margins in the already declining video business. All adding up to an overbuilder like WOW having lower penetration rates (28% of homes passed), thus lower margins and generally viewed as an unfavorable business model compared to the incumbents.

However, times are changing, as more people cut the cord and move away from the broadband/video cable bundle to just seeking out a broadband internet provider, WOW's value oriented proposition starts to look pretty good, offering similar speeds at a lower price. With a recession potentially on the horizon, WOW might also benefit from the cord cutting trend accelerating and their position as a value offering as consumers look to cut costs. To provide some perspective, 90% of WOW's new customers are only buying broadband. Cable valuations have come down recently, partially due to rising competition, new competition is less likely to join the fray into WOW's already competitive markets, rather fiber-to-the-home overbuilders are more likely to focus on markets where the incumbents are vulnerable to new competition.

On the downside, WOW is currently trading at only a slight discount to Charter and the struggling Altice USA (ATUS), where CHTR/ATUS have better business models as a incumbent cable providers. So there is some deal premium baked into WOW, maybe a turn worth. I pulled the above public comparables from TIKR, I realize each is a bit different, especially throwing DISH in there. I don't love the idea of adding another speculative merger position to my portfolio, but this one just seems to make too much sense for a PE buyer to take private.

Substacks That Make You Go… Hmm 🤔

(1) Understanding Jane Street

Great piece on Jane Street, market making, risk, prop trading, OCaml and more.

In one sense, every investor is a market maker and the only difference is their timeline. Jane Street is far along the continuum towards strict market-making: being willing to buy and sell assets at a price close to, but not exactly at, the market price.

But what you actually want to spend most of your time on is thinking about ways things can go wrong. It's not a short list.

Correlations can break, or reverse. They're especially prone to reversing if people trusted them and bet accordingly (if Ford and GM always correlated, but GM launches a new vehicle that starts taking serious share from the F150, a naïve systematic investor will be long Ford and short GM because of the growing valuation gap, even though that gap reflects a change in the real world. When they exit the trade, the gap will get even bigger.)

Prices move overnight, and there isn't time to exit illiquid positions.

Rules change. If you were arbitraging the difference between prices of Russian stocks and US-traded ADRs representing those stocks, you might find that one side of your trade was suddenly illegal.

And the rules don't just change because of geopolitics. Sometimes, a financial institution will decide that one of its customers is too big to fail, and good luck to everyone else. Jane Street, incidentally, is suing the London Metals Exchange over voiding trades ($, FT). This happens in other cases, too. Some of the funds that made good bets against mortgage-backed securities in 2007 found that their brokers were very reluctant to mark those trades accurately.

More prosaically, but just as expensively: code sometimes has bugs. Market data feeds are not always 100% prompt or 100% accurate. Keyboards are not necessarily coffee-proof. And when margins are low and turnover is high, the impact of even minor technical errors can quickly be magnified.

One of the meta questions to ask about an automated trading firm is: what do they want to ensure is the most reliable piece of code they have? Yaron Minsky has answered this in an interview: "We have lots of ways of turning things off, including a literal physical big red button." There are many ways to avoid blowups, but the future contains plenty of unprecedented events, and the only way to deal with them is to find a way to stop doing anything else until it's clear what to do next. And this is a case where readability, clarity, and reason-about-ability are all critically important: as anyone who has worked for a big government agency, corporation, or other bureaucracy knows, the hardest feature to engineer is an off-switch.

(2) Value Situations: Weekly Bulletin #23

Great stuff by Value Situations on the constrained supply of key commodities:

Amid the ongoing headlines about demand destruction due to commodity inflation and recession fears, it strikes me that many analysts and commentators are overly focused on demand-side economic forces, and ignoring serious and likely structural supply constraints.

Across the wider commodity sector, the capex picture is similarly restrained - overall capex levels for commodity producers remain well below historic levels and rising interest rates will only further limit the availability of capital to fund new supply at a time of energy and food scarcity:

In short, supply is precarious and in a world of increasing and sustained scarcity, key materials and commodities that are needed the most will be prized the most, and I see the companies that operate within the supply chains of these as standing to benefit from this set-up in the coming years.

Tweets That Make You Go… Hmm 🤔

Friends of The Rational Cloning

Philoinvestor Substack: a philoinvestor (noun) is someone that engages in investments and decision making using a philosophical, educated and unemotional thought process.