Welcome to the 71st edition of the Rational Cloning Newsletter (Weekly Ideas Series).

Helping you discover the best ideas of others.

Happy cloning.

Tweets That Make You Go… Hmm 🤔

Herb Wertheim is a coffee-can portfolio billionaire.

He stuck with recent duds like $BB, $BAC and $GE too long.

But his stubbornness to sell also led to owning $MSFT and $AAPL since their IPOs and a 500 bagger in $HEI.

Be like Herb.

When will US Natgas peak?

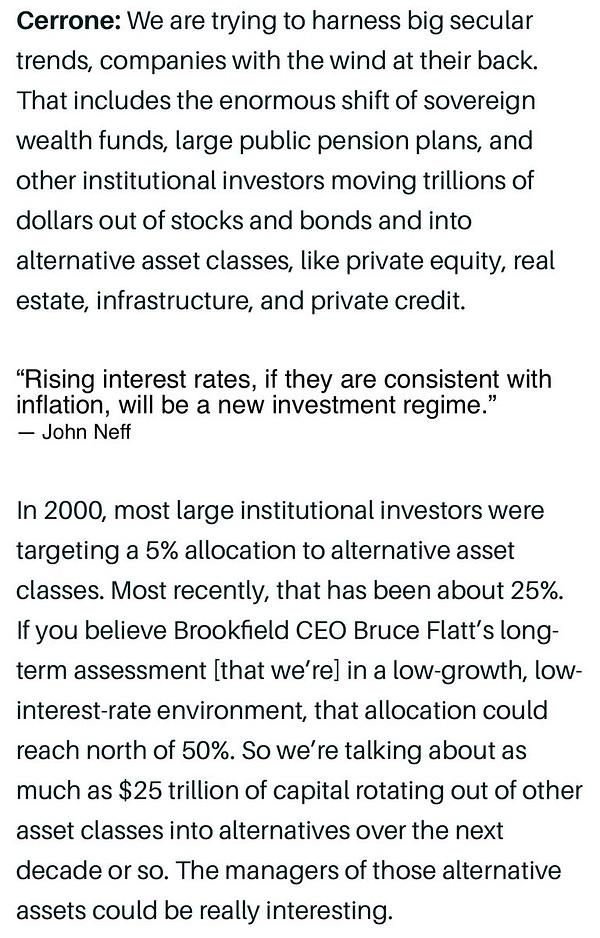

Since 2000 the USA has undergone a rapid rise in Natgas production primarily driven by several shale plays.

The good news is that the rate of growth has been steadily falling (excluding a brief hiatus due to covid) to ~3% per year. A🧵1/x

James Davolos discusses inflation @OnTheMarginPod with @MarkYusko and @MikeIppolito

horizonkinetics.com/videos/james-d…

Apple:🎙 apple.co/3R06uya

Spotify:🎙 spoti.fi/3J1q1fD

#inflation

Last year, I published a book titled Global Outperformers, where I studied listed companies that returned more than 1,000% in 10 years.

There are four parts to our study, and I will share a thread below, sharing somethings our book explores about global equity investing.

1/68

$BAM is a beast - Fee-related earnings, excluding performance fees, climbed to $576M from $456M in the year-ago quarter. FRE growth accelerated to 26% in Q4 2022 from 15% growth in Q4 2021

"But what happens when EPS is declining? According to Birinyi, 70% of the years that earnings have declined since 1970 have seen positive market returns averaging 19% over the same period."

Semi-regular reminder that all RMR Group properties are straight trash and (in my opinion) uninvestable for minority shareholders. This is an opinion, do your own due diligence.

Steads @winsteadscap