The Rational Cloning: Weekly Ideas #58

Alluvial and Fairlight Q3 Letter, Variant Perception Blog on Fixed Income Duration, Substacks/Blogs & Tweets That Make You Go… Hmm 🤔

Welcome to the 58th edition of the Rational Cloning Newsletter (Weekly Ideas Series).

Helping you discover the best ideas of others.

Happy cloning.

Weekly Investment Ideas

(1) Alluvial Q3 Letter

ECIP Banks

Alluvial Fund has an important new investment in a group of community banks. Thanks to a new Treasury Department program, numerous small financial institutions have received a generous infusion of low-cost permanent capital. This program will result in an incredible increase in profits for several of the recipients, but the market has not yet adequately priced in this game-changing development.

Alluvial Fund is invested in three ECIP program banks. BankFirst Capital Corporation is a $2 billion Mississippi bank holding company that received $175 million from the ECIP. Already, BankFirst has acquired one bank and is working to acquire another, fellow ECIP recipient Mechanics Bank, which received $44 million. I fully expect BankFirst to acquire additional banks. United Bancorporation of Alabama received $123 million. Just before the ECIP investment, United Bancorporation of Alabama repurchased 5% of shares outstanding. I expect the company to continue returning capital in proportion with its ECIP-driven earnings growth. Finally, Bay Community Bancorp’s Community Bank of the Bay received $119 million, equal to nearly 180% of the bancorp’s June 30 shareholder equity—a stunning multiple. The California bank also got in the act of returning capital, repurchasing 3.2% of shares outstanding in August.

P10 Builds

Alluvial’s largest holding remains P10 Inc., owner of a diversified set of alternative assets managers. Second quarter earnings were strong and saw continued organic growth in assets under management. Shortly following the earnings report, P10 announced an acquisition that will grow assets under management and be accretive to free cash flow per share, in a deal that closed just days ago in mid-October.

P10 has purchased Western Technology Investment, a manager of venture debt funds. Founded in 1980, WTI has provided nearly $8 billion in debt commitments to venture companies largely in the technology and life sciences sectors. Building on this track record, WTI is expected to launch a new fund in 2024. P10 purchased Western Technology Investment for $97 million in cash plus the equivalent of $40 million in P10 stock, representing a multiple of 11x WTI’s pre-tax cash flow. The deal also includes an earn-out provision if WTI’s earnings achieve certain thresholds.

This transaction will benefit P10 by growing fee-paying assets under management to at least $19.9 billion, as well as increasing both the average fee rate on and average duration of assets under management, resulting in annualized revenues climbing to $200 million. Given these improvements, adjusted for the additional debt and higher interest rates, I now estimate P10’s annualized free cash flow at 84 cents per share. If WTI hits the high end of its earn-out range, that free cash flow would increase to 91 cents per share. Currently priced around $10.30, P10 shares change hands for just 12.3x forward-looking free cash flow, less if the WTI investment works out well. Increases in AUM from P10’s existing strategies will further depress that multiple.

Meanwhile, P10 shares are just plain depressed. It’s not hard to see why.

The economic picture is rocky. There are concerns about the ability of alternatives managers to raise capital amidst jittery equity and debt markets. It may seem like an inopportune environment in which to own a small, little-known alternatives manager. But nothing about the P10 story has changed. The company still enjoys supremely predictable, highmargin revenues looking out several years. Management is still as sharp as they come and wellincentivized to grow the value of the company, not least because they own most of it. Free cash flow per share will continue to grow and the market will come around in the end.

Unidata and the Value of Ambition

Despite the flow of negative headlines out of Europe, Alluvial’s second-largest holding, Unidata SpA, is thriving. First-half results saw Unidata’s customer count rise 29% year-over-year and its fiber network expand by 35% to 4,920 kilometers. EBITDA rose 53%. The company issued a €10 million bond to help finance the construction of a green data center in Rome. Most excitingly, the company announced two large new initiatives: the doubling of the scope of its “Unifiber” project installing fiber in unreached areas of Lazio, plus “Unitirreno,” a proposal to build an 890 kilometer submarine cable in the Tyrrhenian Sea connecting Sicily and Genoa. In order to finance this major expansion of Unidata’s footprint, the company will seek to raise up to €50 million in equity capital and simultaneously uplist to the STAR segment of the Borsa Italiana in 2023. I expect the improved trading liquidity and higher profile will help Unidata shares achieve a more reasonable valuation

(2) Fairlight Alpha Fund LP Q3 2022 Letter

Banks in the United States

We mentioned in previous letters that we were seeing good value in the US market, particularly in financials. First of these areas were the US banks and specifically US community banks. Some excellent analysis has been published in this area by @dirtcheapstocks highlighting some particular opportunities arising from the Emergency Capital Investment Program (“ECIP”). Under the ECIP the Treasury will provide up to $9 Billion to depository institutions with $2 billion set aside for CDFIs (Community Development Financial Institutions) and MDIs (Minority Depository Institutions) with less than $500 million in assets, and an additional $2 billion for CDFIs and MDIs with less than $2 billion in assets.

As of September 21, 2022, a total of 162 community financial institutions have received investment of $8.28 billion. Several banks have been given transformative amounts of funding from this program in order to boost economic growth in their local communities. Two of note are M&F Bancorp Inc. (the parent company for M&F Bank) and Citizens Bancshares Corporation (the parent company for Citizens Trust Bank). They issued preferred stock of $80 million and $95.7 million respectively in June of this year. The preferred stock has been confirmed to qualify as Tier 1 capital by the Office of the Comptroller of the Currency (OCC), Board of Governors of the Federal Reserve System (Board), and Federal Deposit Insurance Corporation (FDIC)2 .

This means that the Tier 1 capital for these two banks has changed from $44 million (19.9% bank Tier 1 ratio to risk-weighted assets) at year-end 2021 to over $120 million for M&F Bank and from $56.2 million (18% bank Tier 1 ratio to risk-weighted assets) to over $150 million for Citizens Trust Bank. Over time we would expect these banks to leverage this capital, thus increasing the overall size of the banks and their ability to fund loans for their respective communities. The earnings of these banks have begun to increase as assets grow and they build up low-cost deposits. They are also being supported by the larger banks. For example, Citigroup enlisted several community banks (including M&F Bank) in a $1.2 billion syndicated corporate loan deal. And Bank of America recently doubled their MDI deposits with an additional $100 million invested.

Substacks That Make You Go… Hmm 🤔

(1) The Variant Perception Blog: Sticking to Fixed Income Duration Overweights

Recently enjoyed listening to this conversation between Jesse Felder and Tian Yang of Variant Perception recently and decided to follow their Substack (their most recent post below)

Our analytical framework involves 3 different time horizons:

Tactical (1-3 months trading outlook)

Cyclical (6-12 months liquidity/growth outlook)

Structural (2-3y+ outlook based on valuation, regime shifts, demographics etc).

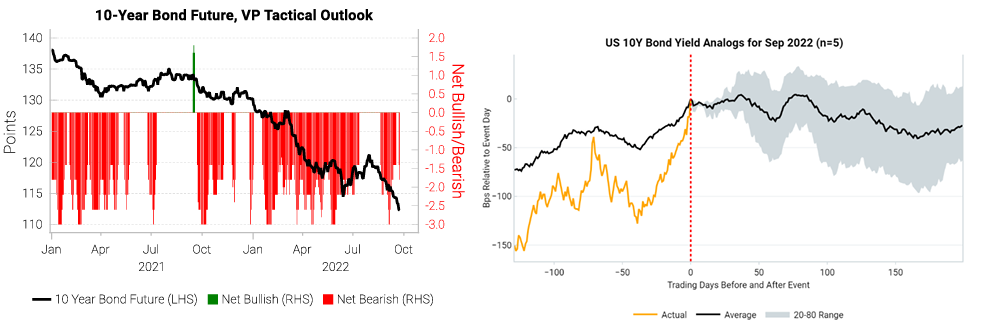

Today, for fixed income, all our cyclical indicators support buying dips on a 6m+ outlook. The only concern is that the short-term tactical trading context remains bearish and needs to clear up before a max long duration trade. The below is an excerpt from our Sep 27th report to clients.

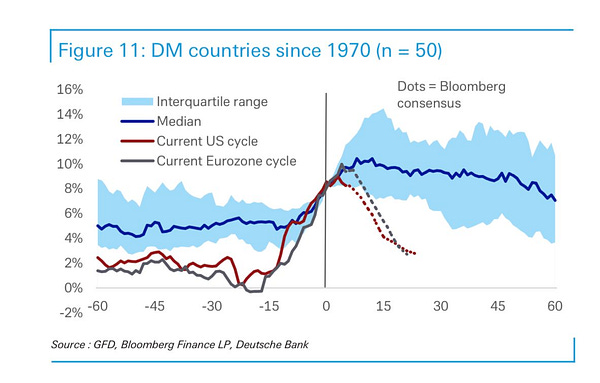

We revisit FOMC transcripts during the Volcker-Fed era to give us more context on the structural set up for bond investors. Our key takeaways: FOMC members viewed long-dated yields as a signal of inflation expectations and credibility of the Fed’s disinflationary policies and the FOMC was worried that the public would expect a monetary policy U-turn as the recession deepened.

“[The] real purpose of our October 6 actions was to get inflation under control… we’re right in the midst of a great credibility test...I think that our credibility and hence our impact on long-term rates will be messed up if we don’t meet those goals that we’ve announced.” – San Francisco Fed President John Balles (20th Nov 1979).

‘‘If we were to attempt to ease, it’s pretty clear that everybody would think we had let the inflationary cat out of the bag. And it seems to me that interest rates would be even higher under those circumstances.’’ – Fed Governor Schultz (31st March 1981).

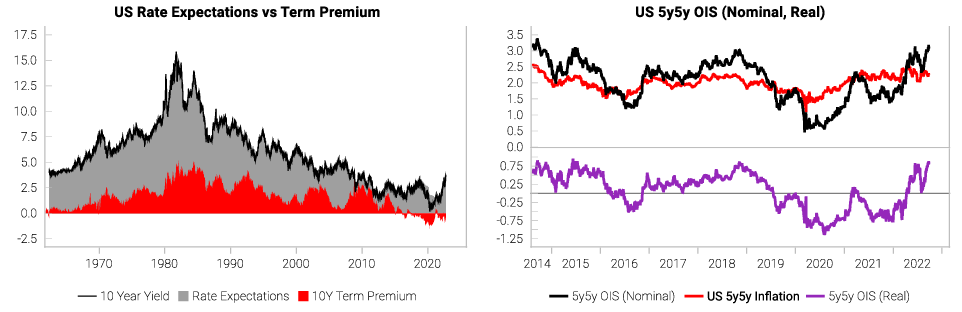

In an echo of Mario Draghi’s “whatever it takes” moment, Powell was unambiguous in stating that Fed policy “will be enough” to contain inflation. The inflation swaps market agrees. The left chart shows the inflation swaps term structure remains well behaved and trades below 3%. The OIS term structure (right chart) has also been dragged up materially vs earlier in the year.

Surging term premium would be a sign of loss of Fed credibility, and is a key risk for our bullish bond views. But there are little signs of that so far. The 5y5y real OIS (right chart below) has jumped higher once again in response to the latest Fed actions.

All our major growth leading indicators continue to make new lows, with the eurozone and China still mired in recessionary conditions. The US recession model has not triggered yet, but continues to show rising recession risks.

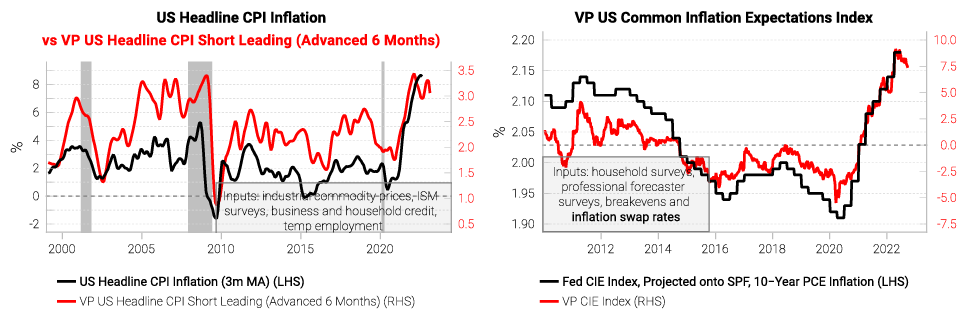

Our US inflation leading indicator stills shows the “inflation plateau” we have been highlighting. An inflation plateau will help to shift the market narrative from “inflation scare” to “recession scare”. This should be supportive for bonds, but not so much for equities. Our inflation expectations indicator, the CIE (right chart below) is also now rolling over slowly, affirming the inflation plateau.

Putting these together, the combination of a) growth LEIs making new lows, b) rising US recession risks, c) other major economies already in recession and d) peaking inflationary pressures are bond bullish. It is likely still too early to position for bull steepening on major policy easing (we are still waiting for a major risk asset crash and/or labor market pain). For now, we still maintain the flattening/inversion bias we have had all year.

The main challenge to our 6m+ bullish bond view is the tactical set up. On our main tactical context tools (1–3-month trading outlook, left chart below), the trading direction remains bearish bonds (i.e. higher yields). The historical trading analogy finder (right chart below) also sees yields going higher first before plateauing.

Tweets That Make You Go… Hmm 🤔

Loved the diverse content: market cycle (variant perception), inflation history, and Zen (!)