The Rational Cloning: Weekly Ideas #77

Turtles / IJW's Various Ideas, Tweets/Ideas That Make You Go… Hmm 🤔

Welcome to the 77th edition of the Rational Cloning Newsletter (Weekly Ideas Series).

Helping you discover the best ideas of others.

Happy cloning.

Weekly Investment Ideas

(1) Turtles all the way down!: Updates and rebalancing #1

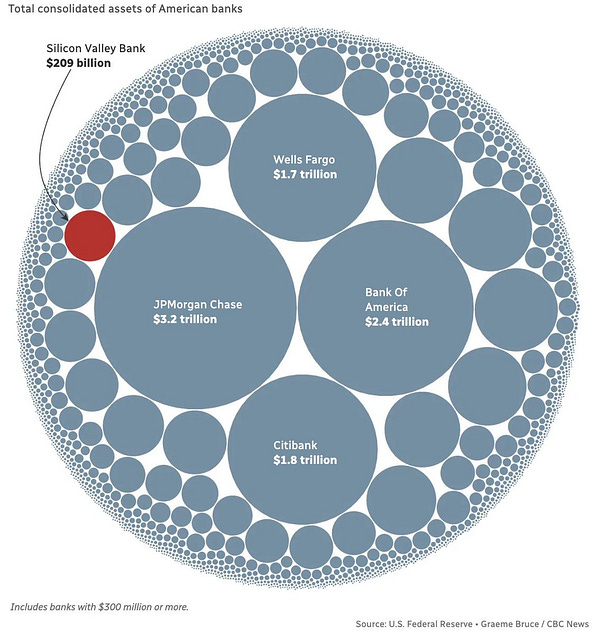

I did some more thinking on Master Residential Fund (URF.AX) and decided to sell my shares. I don’t think the margin of safety is large enough. If you factor in renovation costs, transaction costs and cash burn, it kills a lot of the upside from here. It is not clear to me these costs are factored into their NAV number. Just a small downwards movement in home prices kills the rest. So with shares being up about 12% since posting it a month or so ago, I am closing it. Especially now that I see so many bargains elsewhere due to this SIVB nonsense.

I will close the Tim S.A. TIMB 0.00%↑ position as well. I mentioned I owned this stock in October last year. Return so far has been about 30% including the dividend. But margin compression has been a bit more than I expected in the latest quarter. I find it kind of hard to estimate normalised earnings, and again too many other cheaper stocks around now.

I also greatly reduced my Toya $TOA position to speculative. I think there might be further margin compression, and I am only keeping a small tracker position.

I added to my Halyk Bank (HSBK) position. Management has given guidance for 2023 for about $1.5 billion in net profit. This means the stock trades at about 2x earnings, which is pretty crazy. Only a 25% payout would mean a 12.5% dividend here. Given the very high ROA and ROE this bank is generating, this might not be sustainable? But still, 2x earnings, is 2x earnings right? Hard to ignore, especially with a double digit dividend yield.

Petrobras PBR 0.00%↑ management has given strong indication in the recent conference call that the company will spend no more than a few billion $ a year on renewables. And basically in the short and medium term it will stick to their 60% of FCF dividend formula. So I added some yesterday right before the shares fell another 5%. @#$%&!

I also bought back into British American Tobacco BTI 0.00%↑. I had forgotten about this stock, and it is still in my active ideas list. There are some fears the Menthol cigarette ban will significantly affect profits, but I think those fears are overblown. Stock is trading at a 13% NTM FCF yield and a 8%+ dividend yield. I expect with the cancellation of their buyback, this is soon added to their dividend? Check out this recent write-up in case you are not familiar with the stock.

Tobacco stocks always periodically sell off, as the news flow is usually bad. I think just focussing on the numbers and collecting those large dividends is the winning strategy.

Then I got 2 new stocks, one of which I already finished an article on, which I will send out soon as well.

As usual, do your own due diligence, and I may sell and buy any of the mentioned stocks at any time.

(2) Turtles all the way down!: Pagseguro, a cheap compounder?

I was complaining recently that I couldn't find any cheap stocks, but I will take that back! I got another one, Pagseguro PAGS 0.00%↑. A Brazilian payment processor and online bank and potential compounder.

PAGS trades at about 8x through earnings, has been growing quite rapidly and could see explosive short term earnings growth if they can bring down their financing costs. And they can expand their EBIT margins as Gross profit seems to grow faster than their operating costs. Benefitting from, what I like to call, the Holy Trifecta of value investing: Margin expansion, Multiple expansion and Revenue growth.

Conclusion

Really the main reason this is cheap is high interest rates. When your hurdle rate stays at 13.75%, 8x earnings isn’t really cheap. So obviously they have to come down at some point, and earnings will have to grow for this idea to really work. If inflation again increases (See the 90’s and early 2000’s) rates could go far higher than they are now. That is really the main risk here. But I think the odds of this happening in the short and medium term are low.

With real rates at 8%, and inflation coming down to low single digits, downward pressure on rates is far greater than upward pressure. Brazilians are underbanked, e-commerce is likely to grow much faster than GDP in the foreseeable future, and PagBank is still under monetized. With half the number of users as Nu Bank (NU) which is valued at $20 billion vs PAGS market cap of $2.7 billion.

I only looked briefly at StoneCo (STNE), their main competitor. The main differences seem to be that they focus on larger clients and don’t have a banking segment. And they are more focussed on software, with SaaS revenue being about 10% of its market cap.

They have grown faster, but PAGS seems to have a cost of funding advantage with lower financing costs and actually has pricing power over STNE. And trades at a much cheaper valuation. If revenue growth levels out for both, and interest costs come down, I think PAGS will do better.

Obviously if STNE continues to grow faster, then in the long run STNE will do better. But I am not really a growth investor, and TIKR forward estimates show similar estimated revenue growth. I also don’t really know these types of businesses inside out, so that is why I like PAGS better.

So for all the above reasons I have taken a position at $8.3/share in PAGS.

Tweets That Make You Go… Hmm 🤔

Check out previous issues of Weekly Ideas👇

The Rational Cloner’s Library

Mosaic Musings #2: Disinflation → Inflation Inflection Point?

Mosaic Musings #3: Royalty Companies: Inflation, I win; Disinflation, I Don’t Lose Much.