Welcome to the 73rd edition of the Rational Cloning Newsletter (Weekly Ideas Series).

Helping you discover the best ideas of others.

Happy cloning.

(1) The Variant Perception Blog: The Age of Scarcity Part 3: The Capex Supercycle

An old asset base + large infrastructure spending gap + negative real financing costs (financial repression) = an incoming capex supercycle. This is the final part of our 3-part series based on the insights from our “Age of Scarcity” thematic report sent to VP clients in November 2022. See here for Part 1 and Part 2.

The US’s fixed asset base is extremely old. The last time it was this old was just after WWII, which preceded a huge capex reconstruction boom. The American Society of Civil Engineers has graded the US infrastructure as C-. The Global Infrastructure Hub estimates that the infrastructure spending gap is now at 800bn USD per year (right-hand chart). The surge in net-zero commitments will also necessitate plenty of investment and capex.

Listed infrastructure typically trades at a premium relative to equities because of their more predictable cash flows (bottom right chart). Today EV/EBITDA multiples are at the top of their historical range.

The solution: find capital-scarce and government-aligned infrastructure companies. These companies are most likely to outperform after the business cycle downturn.

Upstream industries offer a more levered way to play the capex supercycle. Infrastructure assets offer investors inflation-linked exposure with an upside takeover / valuation catalyst.

(2) Horizon Kinetics Inflation Beneficiaries ETF (INFL) 2022 Annual Letter

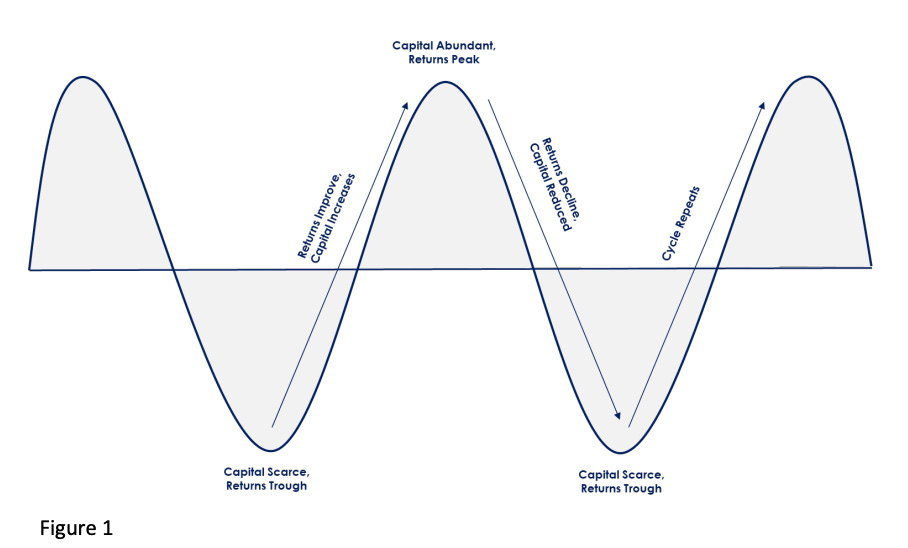

The cornerstone of our nonconsensus investment positioning is our emphasis upon hard assets. Hard assets are simply tangible, finite resources which have largely inelastic demand and limited supply growth potential. Examples include energy, precious metals, base metals, agricultural commodities, and land. Companies engaged in these industries are typically capital intensive and highly exposed to the market cycles, and therefore, they trade at low cash flow multiples. Furthermore, many of these industries experience extreme “capital cycles” (Figure 1): capital chases high returns when market conditions are accommodative, ultimately increasing supply such that forward returns are dismal, following which capital flees the industry. These violent cycles can result in sharp (episodic) gains, but also substantially impair capital, particularly in highly indebted companies with poor unit economics. This helps explain why there is such a dearth of successful long-term investment track records in hard asset equities.

The best way to protect against such a scenario is to recognize the volatility in these subindustries and to invest in efficient, capital light business models that are less susceptible to striking out. Tempting as it may be to try to hit a home run and embrace companies with the highest leverage to higher hard asset prices (i.e., indebted mining and energy extraction companies), these businesses are far more prone to the permanent impairment of capital. On the other hand, capital light businesses are consistently hitting singles and doubles, slowly compounding value. This summarizes our strategy and positioning: though returns may be variable, we emphasize companies that we are confident can prosper through drawdowns and compound capital over time.

The balance of the portfolio is allocated to brokerage, health care, timber, real estate, defense and land companies that share the ability to grow revenues in excess of costs in an environment of rising prices. Similarly, these companies are not directionally dependent upon rising price levels to generate economic returns but have the ability to benefit from higher prices. As always, we continue to evaluate new and unique business models that have these dynamics.

Tweets That Make You Go… Hmm 🤔

Check out previous issues of Weekly Ideas👇

The Rational Cloner’s Library

Mosaic Musings #2: Disinflation → Inflation Inflection Point?

Mosaic Musings #3: Royalty Companies: Inflation, I win; Disinflation, I Don’t Lose Much.