Welcome to the 41st edition of the Rational Cloning Newsletter (Weekly Ideas Series).

Helping you discover the best ideas of others.

Happy cloning.

Weekly Investment Ideas

Anybody got a weird security or three I can check out this weekend? There are only so many hot dogs to eat and fireworks to set off. Gonna need some other entertainment. The smaller and less liquid the security, the more I like it.

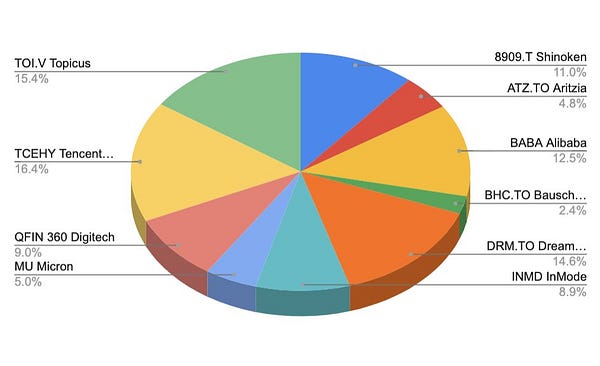

Current Portfolio:

$8909.T Shinoken

$ATZ.TO Aritzia

$BABA Alibaba

$BHC.TO Bausch Health Companies

$DRM.TO Dream Unlimited

$INMD InMode

$MU Micron

$QFIN 360 Digitech

$TCEHY Tencent Holdings LTD

$TOI.V Topicus

Zero disposals.

Will be adding $EVVTY

Tweets That Make You Go… Hmm 🤔

Between Wednesday- Friday $BRK purchased 8M more shares of $OXY ~$58/ share.. Total ownership of 163M shares total, 17.3% ownership.

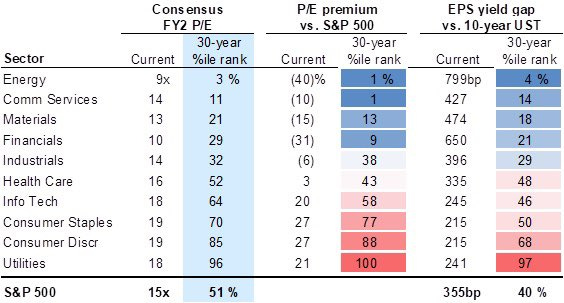

1) Interesting data from MF at GS this morning.

Energy and Comm Services sectors are both at 30 year low valuations relative to the overall market. Energy cheaper in absolute terms

Comm Services essentially just GOOGL, FB, T, VZ, CMCSA, CHTR, DIS, NFLX (85%ish of the index).

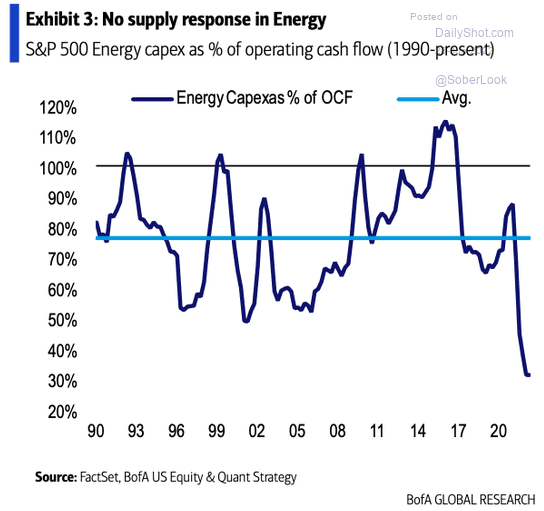

Wild to see the lack of supply response.

Any energy specialists have any pushback on why this may be wrong? Private operators picking up the slack from pubcos?

Observation #45:

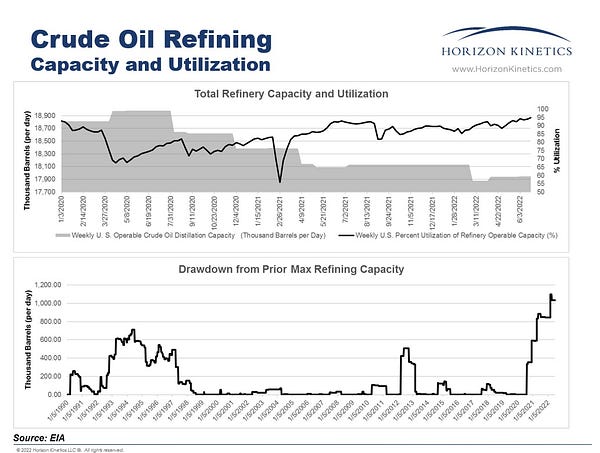

Lost refining capacity since March 2020

Since mid-2020, the United States has lost the ability to process over 1 million barrels of crude per day. This is the largest drop on record.

Fantastic holiday reading. Thanks.