The Rational Cloning: Weekly Ideas #39

Colarion on Banks, Tweets on Alternative Asset Managers, and Tweets That Make You Go… Hmm 🤔

Welcome to the 39th edition of the Rational Cloning Newsletter (Weekly Ideas Series).

Helping you discover the best ideas of others.

Happy cloning.

Weekly Investment Ideas

(1) Colarion LLC on Banks

(2) Some Tweets Related to Alternative Asset Managers (“Alts”)

@blackstone Stephen Schwarzman, CEO of $BX, on the effects of rising rates, inflation and recession on Private Equity and alternatives in general. As above, this is an extract from the Bernstein Conference.

#StockMarket #Investing

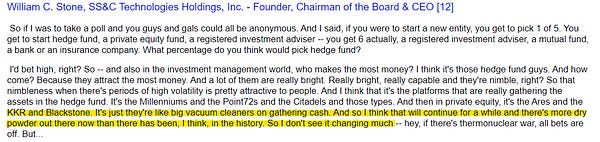

Bill Stone $SSNC making the one-liner elevator pitch for the listed alts managers $KKR $BX $BAM

The runway remains long.. and I doubt even 5% rates stop the flows to these firms

Whether you like Brookfield or not, they do offer some timeless advice in their letters to share owners. This one, from Q3 2015 has some good reminders for today. $BAM

Apollo Co-President, Jim Zelter, very excited about M&A prospects:

"larger, more complicated opportunities...they are going to happen in the second half of 2022, no doubt. we certainly feel like there's a robust M&A pipeline"

(1/2)

$APO at MS Conf. 6/14/2022

$APO and $CG slow flagship fund raise schedules

APO, BX and CG all in market with flagship funds looking for $70B total, while allocators struggle to invest more into the asset class as their models dictate bringing public stocks back to target

$BX “asset light, brand heavy” comments from MS conf now. No net debt vs the 120b market cap. Paid 100% of earnings out in form of divs and buybacks, earnings compounded 35% a year since ipo. Completely disagree with a TAM for Alts biz-there’s always new opportunities created

Tweets That Make You Go… Hmm 🤔

It took Microsoft $MSFT ~17 years to reach its 2000 all-time highs.

But yes, I'm dying to know how your shitco will bounce back to trade at new highs in the next 12-18 months.

Growth is still massively overvalued vs history.

Small caps and low-multiple stocks starting to look very cheap. However, this is based on current PE estimates. If estimates fall, growth will look even more expensive, while small caps and low-multiple stocks may not look cheap.

1/ Since disorder is spontaneous, the human endeavor is a constant, unrelenting struggle against the forces of entropy. We are a highly ordered species – a true miracle of the universe. Beating back entropy requires energy. Ergo, energy is life.

Can’t buy crypto because it’s too risky

Can’t buy stocks because of treasury yields

Can’t buy bonds because of inflation

Can’t buy real estate because of interest rates

Investing is a tough game

Top Lessons from Constellation President's Letters Part II

$CSU.TO $CNSWF

Revenue per share is a great metric in for software companies. Why?