The Rational Cloning: Weekly Ideas #35

Goehring & Rozencwajg Q1 2022 Letter; Tweets That Make You Go… Hmm 🤔

Welcome to the 35th edition of the Rational Cloning Newsletter (Weekly Ideas Series).

Helping you discover the best ideas of others.

Happy cloning.

Weekly Investment Ideas

(1) Goehring & Rozencwajg Q1 2022 Market Commentary

The world has enjoyed a decade of cheap, abundant energy and nowhere has that been truer than in US natural gas. We consume nearly as much energy via natural gas as we do via crude oil, although it is usually an afterthought. The rest of the world is in the midst of an acute gas shortage that has grabbed everyone’s attention. We believe the same is about to happen in the US -- much faster than anyone realizes.

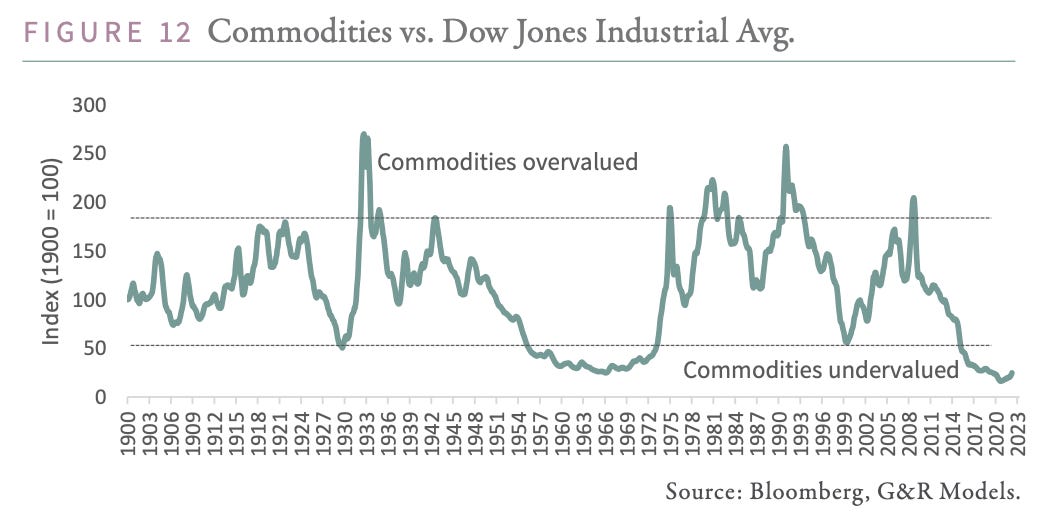

Not only is the commodity bull market not over, it has hardly begun. Look carefully at the chart below.

Out of Spare Capacity

Once investors and institutions realize the energy market has fundamentally changed and the decade of cheap, abundant energy is over, the amount of capital that rushes into this sector could be huge. The global energy crisis has just started, and it will take many years to fix. For those that make investments today, the rewards could be immense.

Catastrophic Agriculture Markets

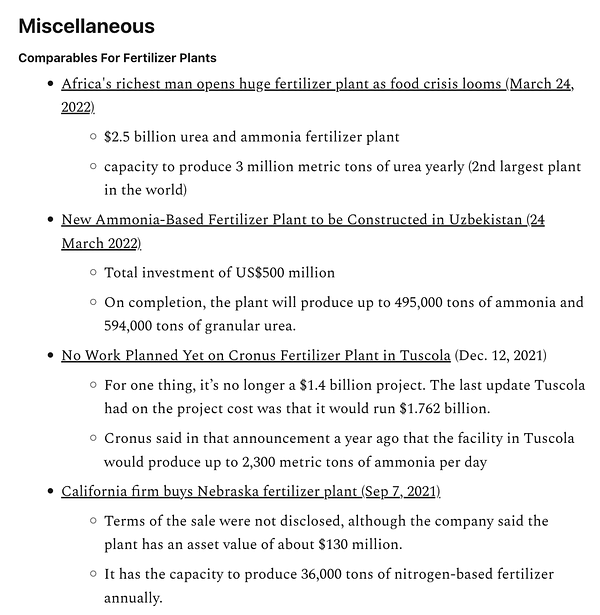

We continue to recommend investors have significant exposure to agricultural related equities, including the fertilizer stocks. Although these stocks have had large upward moves over the last 12 months, they remain extremely cheap based upon their earning power.

Russia and the Uranium Fuel Cycle

Even before all this renewed interest in nuclear power, the uranium market was in severe long-term structural deficit—a deficit that could only be solved by much higher uranium prices. When we made our uranium investments in 2018, we did not count on any nuclear renaissance from the OECD world. Given all the renewed interest in building new plants and extending the life of present generating facilities, the long term structural deficit in uranium is set to become even larger. Uranium prices are poised to move dramatically higher as we progress through the 2020s.

Time to Buy Gold is Getting Closer

Summing all this up: we are now getting continued positive data that western investment demand is strongly returning to both gold and silver markets. Gold has now become cheap relative to oil.

Central bank buying , may have turned slightly negative on a short term basis , but we only have one quarter of data and we will have to monitor their activity closely as we progress through the next several months.

And finally, the positioning of traders is giving us little insight into whether the low we saw in gold prices this quarter was the definite low for this cycle. A pull back in gold prices related to the expected Fed tightening might produce much more bullish sentiments from gold futures traders.

However, as of today, this data point is neutral, as opposed to the last bottom in gold back in September 2018 when it was strongly positive. Given the return of the western investor, the cheapness of gold relative to oil , the surge in inflation, and Russia’s invasion of Ukraine, we believe the next leg of the gold bull market may have already started and we have begun to increase our exposure in the accounts we manage. The only thing that continues to nag us is how gold prices might react to the Fed’s tightening of monetary conditions.

Tweets That Make You Go… Hmm 🤔