The Rational Cloning: Weekly Ideas #14

Clark Street Value, Interesting Insider Transactions, Global Inflation Rates, What Happened to ARKK?

Welcome to the 14th edition of the Rational Cloning Newsletter (Weekly Ideas Series).

Helping you discover the best ideas of others.

Happy cloning.

Some Minor Changes:

Added a section of insider transactions I’ve tweeted about this week (if you don’t like it, please tell me to remove it)

Changed the tweets section to: “Tweets That Make You Go… Hmm 🤔”

Weekly Investment Ideas

(1) Clark Street Value: Altisource Asset Management: Preferred Overhang, Cash Shell w/ Optionality

Many readers will know this situation, Altisource Asset Management (AAMC) is a cash shell with approximately $80MM in the bank after their only asset management client, Front Yard Residential (RESI), terminated their external management agreement with AAMC resulting in RESI being internalized (AAMC was a 2012 spin, was trendy at the time to spin the management company). Front Yard later sold itself to private equity (Ares and Pretium) which likely will turn out to be a great deal (even after they hiked the offer) for the buyers given how single family rentals have traded since.

Friend of the blog, Andrew Walker did an excellent podcast (and even answered one of my questions on it) with Thomas Braziel and Jeff Moore pitching AAMC. They go into some of the background, particularly on the controversial Bill Erbey, who was formerly an executive (back in the early-to-mid 2010s, Erbey ran Ocwen and a few satellite entities like AAMC), but now is just a 39% shareholder in AAMC after legal trouble forced him out of the day-to-day operations.

(2) Clark Street Value: Sonida Senior Living: Out of Court Restructuring, fka Capital Senior Living

Sonida Senior Living (SNDA, fka Capital Senior Living under the old symbol CSU) recently completed an out of court restructuring led by Conversant Capital, the same investor that has been instrumental in institutionalizing and providing growth capital to INDUS Realty Trust (INDT). While clearly different, the industrial/logistics asset class has covid tailwinds versus senior housing having covid headwinds, the results could rhyme with each other longer term as this micro cap “grows up” (to steal a tweet from “Sterling Capital” @jay_21_, also h/t for the idea). Sonida is now positioned to use their reset balance sheet to take advantage of a fragmented senior housing market with plenty of distress (looking over at our friend RHE), but also with long anticipated demographic tailwinds finally being realized with an increasingly large population aging into senior housing.

(3) Clark Street Value: HMG/Courtland Properties: Microcap REIT Liquidation

HMG/Courtland Properties (HMG) is a tiny REIT that recently announced intentions to hold a vote early next year to approve a plan of dissolution and liquidate. HMG was founded in 1974 by Maurice Wiener, he is 80 and is still the CEO of the company (technically this is an externally managed REIT, but there is no incentive fee), he controls 56% of the shares through various entities leaving little doubt the liquidation proposal will be adopted.

The company’s assets are a bit of mess (this liquidation will probably take several years), but the largest asset is a 25% equity ownership in a newly constructed Class A multi-family apartment building (“Murano at Three Oaks”) in Fort Myers, FL. Construction began in 2019, the building was completed in March and is already 97% leased as of the recently released 9/30 10-Q. With inflation running hot and migration to the sun belt, cap rates on multi-family assets like this one are being quoted below 4%. This is a hidden play on the craziness in multi-family M&A.

(4) Clark Street Value: Advanced Emissions Solutions: Another Informal Liquidation

We’re at the end of earnings season for small caps, this could be stale in under a week (ADES reports 11/10), Advanced Emissions Solutions (ADES) is a $130MM market cap with no debt and by year-end should have ~$90MM in net cash as one of their two business segments is running off due to the expiration of a tax credit. The company announced strategic alternatives in May, likely intending to sell the remaining business segment and effectively liquidate the company. Similar to other informal liquidation ideas lately (LAUR, PFSW, RVI, JCS, BSIG, etc), the downside is protected by the cash generated from monetizing one business segment that could be returned to shareholders either by a tender offer or a special dividend, with upside coming from an M&A event for the remaining segment.

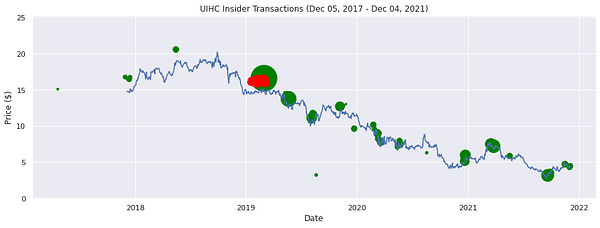

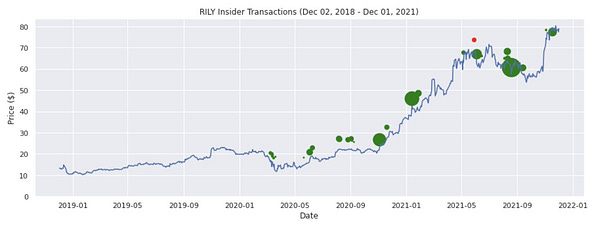

Insider Observations

Tweets That Make You Go… Hmm 🤔