The Rational Cloning: Weekly Ideas #89

Horizon Kinetics on Landbridge, Ideas From Alluvial Capital, Tweets & Ideas That Make You Go… Hmm 🤔

Welcome to the 89th edition of the Rational Cloning Newsletter (Weekly Ideas Series).

Helping you discover the best ideas of others.

Apologies for the long break and thanks for sticking around - I’ll be publishing more regularly going forward.

Happy cloning.

Weekly Investment Ideas

(1) Horizon Kinetics: KMF Conference Call January 14, 2025 [On Landbridge]

The reality is that, the way I look at it, if we could raise $6 billion to $8 billion and buy a bigger stake in TPL or LandBridge, we would control the fulcrum position of the Permian Basin and likely be the largest landholder and landlord of basically where the money’s going to be spent in AI.

So, long way of saying, even though we have concentration, I personally don’t have any fear about that, and I personally buy TPL and LandBridge on a regular basis, as well as Bitcoin. So, even though I’m a very large shareholder in our funds, I’m not backing away from what we’re doing.

This is a slide, courtesy of LandBridge, one of the holdings that we have at the firm, where they show you the full cycle. This is a very simplistic example that was outlined by the chairman of LandBridge and Five Point Energy on a podcast, where he walks through what is just a very basic revenue could be for a data center in the Permian. If you think about what the biggest requirements for data centers in the world or the U.S. is going to be, it’s land, it’s availability to power, and it’s availability to water.

One of these facilities alone is basically a $66 million, 90%+ gross margin almost-perpetual revenue stream. You can see why it’s such an exciting opportunity, and I think you’re going to hear more and more about this as the year matures.

New question about a target price on LB. We don’t have a target price. But that last slide that James went through on what the type of revenue and the type of margins that you can get off of that revenue could be, and times that by X number of gigawatts facilities that they might put on their land, it’s a big number. So, again, it’s not trying to basically make any great predictions on this, it’s just that the world seems to be going where both TPL and LandBridge are. And if that plays out the way we think it will, then even though on current terms, it looks like an expensive stock, but it’s actually not an expensive stock. It’s actually a very cheap stock.

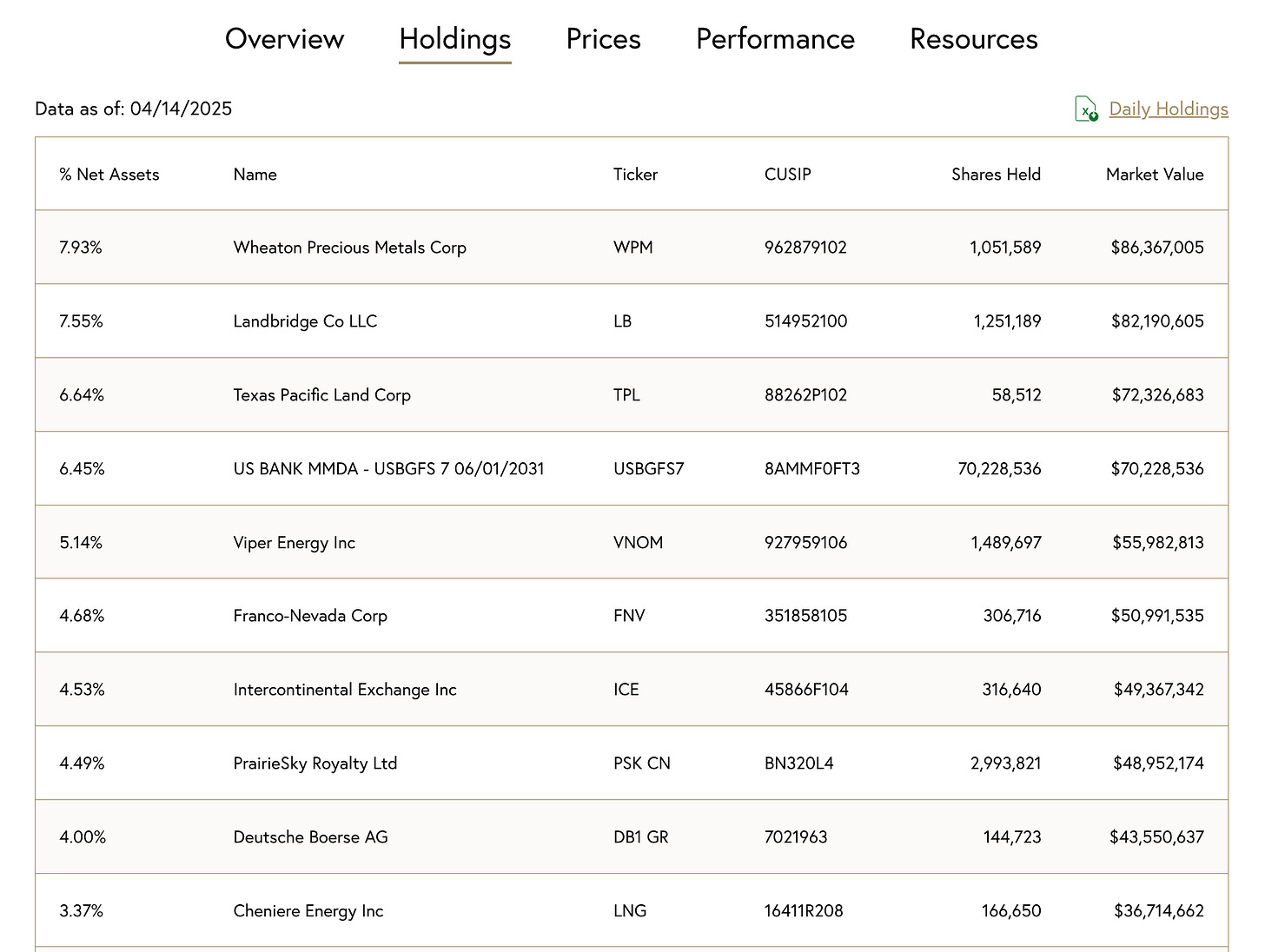

Interesting to see the current LB allocation in Horizon Kinetics’ ETF (INFL) - sits second highest ~7.5%:

Other write-ups on LB:

$LB (LandBridge): An exchange trading floor of the Delaware basin

If the famous oil royalty company, Texas Pacific Land Corp (TPL), is the “ETF of the Permian basin”, then LandBridge (LB) is an exchange trading floor of the Delaware. LB owns uniquely positioned surface acreage in the Delaware basin and has an integrated relationship with WaterBridge (WB) midstream water management, which shares the same management team and majority owner.

WB collects fees on the volumes of water transported, treated, and/or disposed of for customers through their pipelines and at their facilities, while LB collects resource sales, easements, and surface use royalties on water sourced from, infrastructure atop of, and waste water disposed of on their lands —usually from WB 1. The positioning and scale of LB’s acreage also acts as a call option on all other manner of surface use demand that may require water, energy, and acreage in the Delaware basin.

However, IDK that, at a high level, the growth expectations baked into the current price are a great bet to take and a lot of the near- to mid-term price action seems to depend on a tug of war between Jevon’s Paradox driving greater total data center capacity and infrastructure demand vs innovation-driven LLM kWh-per-token deflation —with LB longs rooting for the former.

Six Bravo - LandBridge Company (LB)

If this high level overview of LandBridge peaks your interest in the company, then I would highly recommend that you read the company’s full S-1. The document is much more informative than other similar companies S-1 filings and it goes into great detail about the companies operations. I would also recommend that you research water production in the Permian basin along with the regulatory issues surrounding water disposal in New Mexico to better understand the company’s unique ability to serve that market. Finally, it’s worth reading up on the future of data center development. The data center market is rapidly growing and it’s worth understanding the industry dynamics even if you decide not to invest in the space.

LandBridge has incredible potential but it will take time to fully develop and for that reason I’m dollar cost averaging into the position over time. This is not a spin-off or restructuring that will double or triple in the near term based on a specific catalyst but rather a great company at a fair price with a very long runway ahead of it. Again, just reading more about the company and the industries surrounding it will be a great benefit to you even if you decide not to invest and I highly recommend you spend some time studying LandBridge on your own.

A final note: LB makes relatively little revenues from ownership of oil and gas royalties. This translates into lower sensitivity to oil and gas prices; unlike other land owners in the Permian like TPL or VNOM, LB is more focused on volumes / activity. This can be a double-edged sword that hurts returns if oil prices rise (though they’d benefit indirectly from the likely subsequent increase in drilling activity for Permian operators), but dulls the impact of any down-swings in oil prices (such as those that might come if President Trump is successful in lowering oil prices and increasing total hydrocarbon production in the US).

(2) Dave Waters {Alluvial Capital]

CBL Properties

CBL Properties is a mall owner that restructured and emerged from bankruptcy in 2021. Since, the company has paid off additional debt, sold non-core properties, and returned a lot of cash to shareholders. The company will continue to pursue these three objectives. Shares have tumbled as fears over consumer spending and leverage grow. In my view, shares now trade for the value of CBL’s cash and unencumbered properties, completely ignoring the substantial value in the company’s joint ventures and properties encumbered by the term loan. At year-end, CBL had $9 per share in cash and unencumbered properties that produced $66 million in 2024 net operating income. Valuing these properties at a 15% NOI yield gives another $14 per share in value.

Titan Cement

I am long-term bullish on cement, believing the world is underinvested in raw materials production. Titan Cement is a global producer with operations in Southern and Eastern Europe, Egypt, Turkey, Brazil, and the United States. Shares are traded in Brussels and Athens. After observing the huge gulf in valuations for US cement producers vs. all others, the company wisely chose to IPO its us operations as “Titan America SA,” ticker TTAM. Their timing was good, as there is no way the IPO could go off now. Titan America shares are well off the IPO price and worth a look, but my interest is in the parent company. There are two ways to think about Titan Cement’s value.

Seneca Foods

I started buying Seneca Foods in 2023, when fears over swelling inventory and falling margins lead many investors to steer clear. Perhaps more than any other company in the Alluvial portfolio, Seneca benefits from trade tensions and a weakening consumer. Reduced agricultural imports are supportive of higher veggie prices, and a more precarious economy results in consumers trading down to canned vegetables rather than fresh or frozen. What’s more, Seneca maintains its own can production facilities, cushioning the blow from metals tariffs. Despite these factors, Seneca shares are still down 6% or so this month. The company’s trailing free cash flow yield is extremely robust thanks to working capital release. While this pace of inventory reduction won’t be sustained, Seneca is very well-situated to continue generating free cash flow and returning it via share repurchases. Boring and cash generating are just how I like them.

4Imprint Group Plc

I am looking closely at 4Imprint Group as a very, very good business facing some near-term headwinds. 4Imprint is fundamentally a US business, but it is listed in London. If you have ever gotten a water bottle from a charity 5k race, or a backpack or tote bag with a corporate logo from a company event, there’s a very good chance that 4Imprint provided it. 4Imprint is good at it, and they make a lot of money doing it. Company revenue grew nearly 60% from 2019 to 2024, and operating income nearly tripled. The company is also remarkably capital efficient. Unfortunately, last month the company revealed that orders are down year-to-date on customers’ economic concerns. Shares plunged and are now off 50% from their 2024 highs. Bit of an over-reaction? Could be. 4Imprint shares now change hands for around 8x trailing operating income. The company has net balance sheet cash.

Conrad Industries

Boat and barge builder coming out of a cyclical bottom, with a strong balance sheet and a growing backlog.

Tweets & Ideas That Make You Go… Hmm 🤔

Stanley Druckenmiller: 'I'm not sure if I'v ever made money shorting.'

$TFG.AS, $TFG.L, $TFG With a stock price of $14.9 and trading between 40-50% of NAV, you get…

(3:01) No matter how mundane some action might appear, keep at it long enough and it becomes a contemplative, even meditative act.

(4:00) Pain is inevitable. Suffering is optional.

(19:00) My only strength has always been the fact that I work hard and can take a lot physically. I’m more a workhorse than a racehorse.

(26:00) I’m the kind of person who has to totally commit to whatever I do.

(54:00) Exerting yourself to the fullest within your individual limits: that’s the essence of running, and a metaphor for life.

and with that, the legend continues.

You're back! Amazing news.