The Rational Cloning: Weekly Ideas #36

Tidefall Capital on Netflix, Kuppy on Oil, Alluvial Capital (Value Thoughts), Tweets That Make You Go… Hmm 🤔

Welcome to the 36th edition of the Rational Cloning Newsletter (Weekly Ideas Series).

Helping you discover the best ideas of others.

Happy cloning.

Weekly Investment Ideas

(1) Tidefall Capital Q1 2022

Netflix

With Netflix stock down by more than 50% since its high in November (and 10% below Reed Hastings’ $20m purchase in January) we re-entered the position in April believing we were being greedy when others were fearful. Unfortunately, its most recent results were well below expectations causing the shares to get cut in half (again).

As cable legend John Malone preaches, in the media sector it’s all about scale. The more subscribers a streamer has, the lower the cost of acquiring and distributing that content per subscriber. Even after aggressive marketing campaigns, Netflix still has more streaming subscribers than Disney+, HBO Max and Apple TV+ combined. The benefits of this improving scale can be seen in Netflix’s financials; since 2018 while revenue has doubled, operating income has quadrupled. The current narrative is that these new streaming entrants will be able to continue to steal subscribers, a view that we think is unlikely over the long term given the size of Netflix’s library, the virality of its content and an average cost of just 39 cents per day. Even basic operational changes like releasing content weekly (instead of all at once) or providing annual payment incentives relative to its monthly price should further improve its industry leading retention ratios.

As of today with the shares down 73%, Netflix has an enterprise value of $93b and is being valued at $425 per household or 3x revenue. At its current guidance of a 20% operating margin (which is less than the 25.1% they made in Q4 and less than the Q1 forecast of 21.5%) Netflix is trading for 18x 2022 expected earnings. Last quarter, Netflix also disclosed an estimated 100m users currently accessing the service via password sharing, a practice that other streamers are far more strict with and something Netflix now intends to crackdown on. If 20% of the estimated password sharing users are converted to paying users, at an 85% margin, the PE would drop to just 13x earnings.

(2) Kuppy: The Fed Is Fuct (Part 2)

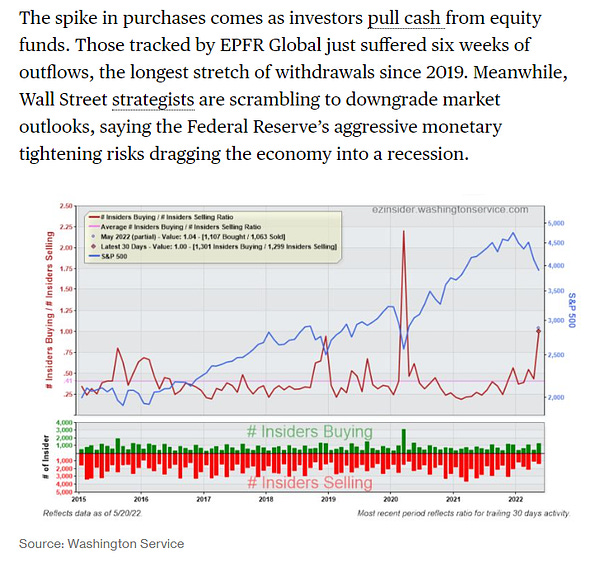

Let’s try a thought experiment here. Fast forward into winter. The Fed has been on autopilot and has continued to raise rates. They’ve managed to crush risk assets and the “negative wealth effect” is rapidly filtering through to the consumer economy. All the guys trading meme stonks and monkey JPEGs have now returned to their prior jobs and the supply chain is “healing.” Wage growth has slowed dramatically, and the influx of labor has led to an increase in unemployment. On a year-over-year basis, every economic metric looks terrible as we comp against record stimulus during 2021.

Normally, we’d call this a recession.

Meanwhile, inflation is stubbornly high, driven by oil that is now at $200/bbl, along with accelerating food price inflation. Who could have predicted that turning corn into fuel would lead to a food shortage? Who would have thought that wheat could hit $30 as the Ukraine war drags on for yet another quarter? As a result of accelerating inflation, the GDP deflator has gone bonkers, and GDP is now clocking in at negative 5%. Meanwhile, inflation is in the teens. Effectively, we’ve created an Emerging Markets crisis. We’re now Turkey.

What do you think the government does?

If you’ve read this blog before, you probably can guess at where I stand. Oil is the wrecking ball that we all deserve. The consensus view is that the Fed will raise rates aggressively if oil hits $200. I have a contrarian view—at $200, they’ll panic. They’ll blame Putin, hedonically adjust the numbers, and go back to money printing, just like they did with COVID. Remember the deluge of liquidity over germs? With oil, they’ll say that Putin is using economic warfare and the economy needs more QE otherwise oil buries it. They’ll reduce interest rates, flood the world with liquidity and activate their acronym programs. The Fed will declare war on oil and use all of their tools.

(3) Alluvial Capital (Value Thoughts)

Western Capital Resources - A Takeunder Without the “Take”

An unscrupulous company can effectively go private by deregistering its shares and then declining to provide financials to OTC Markets (and pay OTC Markets for the privilege.) Shareholders still own their shares, but their value has been seriously impaired as they are completely illiquid. At this point, the company can allow these shareholders to languish indefinitely, or make a lowball offer to shareholders. A great number of shareholders are likely to accept this offer, knowing it could be their only opportunity to realize value on a reasonable time frame. All the usual requirements still apply to deregistering companies under applicable law: shareholder meetings, making financial statements and shareholder lists available to shareholders. But in truth, companies have a massive financial and informational advantage over small shareholders. It is unlikely that retail shareholders will have the means and ability to perfect their rights.

This is what is happening with Western Capital Resources.

Anyone would have to consider selling now and taking the loss. By selling today, you achieve some value for your shares. As much as it hurts, it’s better than possibly getting something a year or more from now with no guarantee the purchase price is higher than today’s market bids. Awful. The only shareholders who should consider buying today are those who trust management to continue running the company well and to someday return full value through a sale or re-listing. The first assumption seems reasonable given the track record. The second does not at all.

Quick Value - Butler National

Butler National is having a great year with shares up 13% year-to-date. And yet, I am mystified that shares aren’t up lots more. To summarize, Butler National owns a Western Kansas casino and an aerospace services business that repairs and upgrades small personal aircraft. The casino business is going gangbusters while the aero business has recovered nicely from the COVID lows.

Butler National purchased its casino building and bought out its business partner, putting itself squarely in control. The timing was good as Butler secured long-term mortgage financing and extinguished the minority interest just as the business reaccelerated post-COVID. In the quarter ended January 31, the casino business produced revenue of $9.3 million and cash earnings of $4.1 million before interest. Results for the quarter ended April 30 should be even better. I don’t think most investors know, but the state of Kansas actually publishes monthly results for each casino. Net gaming revenue for February, March, and April totaled $9.6 million, an all-time high. We could easily see the casino business produce EBITDA of $16 million this year.

Peter Kamin Complex

I have been a long-time investor in multiple companies controlled by Peter Kamin. Calloway’s Nursery and Rand Worldwide in particular have been major contributors to Alluvial’s returns. My biggest mistake with these positions has been every occasion where I reduced our ownership because the shares looked fully-valued or the short-term outlook diminished. In each case, Kamin & Company made me regret it.

What I appreciate most about Kamin’s leadership is the way he views cash and capital returns to shareholders. Calloway’s Nursery and Rand Worldwide are quality businesses. They each produce strong returns on capital and generate significant excess cash. The same is true of many other micro-cap companies, but at those companies, management seems unsure of what to do with this cash flow. They either let it pile up year after year, seemingly terrified or letting it go, or they blow it all on a mediocre investment at the top of the business cycle.

Peter Kamin’s approach to cash seems to be something like this.

Can the business make simple investments that are highly likely to deliver 20-30%+ IRRs in the medium-term? If so, make them, even if they reduce profit this year and next.

Is there cash left over after making these investments as well as a buffer for ordinary operations? If so, return that cash to shareholders with special dividends.

Can the balance sheet accommodate limited debt financing at reasonable rates? If so, take on debt and use the proceeds to offset the equity component of investments and/or supplement special dividends.

Tweets That Make You Go… Hmm 🤔

This is my favorite write up each week