The Rational Cloning: Weekly Ideas #21

1 Main on Basic-Fit, Praetorian on Uranium, Newspapers, JOE, Energy Services, and Oil Futures, Palm Valley on Inflation; Job Opportunities 💼

Welcome to the 21st edition of the Rational Cloning Newsletter (Weekly Ideas Series).

Helping you discover the best ideas of others.

Happy cloning.

This issue also includes a Job Opportunities 💼 section, as I thought it was interesting to see a few opportunities floating around on Twitter, so I decided to highlight them.

Weekly Investment Ideas

(1) 1 Main Capital Q4 2021 Letter

As of December 31st, the Fund’s top 5 positions were Alphabet Inc (GOOG), Basic-Fit NV (BFIT), KKR & Co (KKR), Mastech Digital (MHH) and RCI Hospitality (RICK). Together, these holdings accounted for nearly 60% of assets. I have written about 4 of these holdings in prior letters and not much has changed in our thinking. I discuss BFIT, which is a new position for the Fund, below.

a. Basic-Fit NV (BFIT)

Basic-Fit is the largest low-cost gym operator in Europe, with >1,000 locations supporting >2 million members who pay the company €20 per month, on average. The company operates primarily in France (500+ clubs) and Benelux (400+ locations), with an emerging presence in Spain and probably at least one additional market that has likely already been chosen but is yet to be announced.

At €40 per share, the stock currently sells for 11x my estimated maintenance FCF per share, assuming the existing store base gets back to pre-COVID levels of membership in the coming years. Importantly, the European gym market is still extremely under-penetrated, meaning that BFIT has an opportunity to reinvest its maintenance FCF back into building new locations at predictable and attractive returns.

Nick Sleep articulated the concept of “scale economies shared” where, as a firm benefits from scale, savings are given back to customers in the form of lower prices, allowing the firm to gain market share, which in turn provides even greater scale for the firm to pass on. BFIT encapsulates the concept well. It sells a newer and better offering for a lower cost than competition, leading to more efficient customer acquisition, which drives per-member costs down even further.

In terms of unit economics, a new location typically costs approximately €1.2 million to build, supports 3k+ members, and generates around €375k in annual EBITDA less maintenance capex at maturity, generating greater than 30% pre-tax returns on capital.

(2) Praetorian Capital Q4 2021 Letter

I would like to caution you that our portfolio has become somewhat lopsided in terms of being exposed to inflation assets, particularly with a focus on energy assets.

a. Uranium Basket (Entities holding physical uranium along with production and exploration companies)

It may take some time still, but I believe that society will eventually settle on nuclear power as a compromise solution for baseload power generation. In my opinion, this will come at a time when there is a deficit of uranium production, compared with growing demand. As aboveground stocks are consumed, uranium prices should appreciate towards the marginal cost of production. Additionally, there is currently an entity named Sprott Physical Uranium Trust (U-U – Canada) that is aggressively issuing shares through an At-The-Market offering or ATM to purchase uranium (we are long this entity). I believe that these uranium purchases will accelerate the price realization function by sequestering much of the available above-ground stockpile at a time when utilities have run down their inventories and need substantial purchases to re-stock. The combination of these factors ought to lead to a dramatic increase in the price of uranium as it will take roughly two years for any incremental supply to come online—even if the re-start decision were made today.

While most of our exposure is to physical uranium within the Sprott trust, as it allows us to express this view with reduced risk, we also own shares of Kazatomprom (KAP – UK) along with a few select junior miners. I am well aware that mining is one of the riskiest businesses out there, but Kazatomprom is the lowest-cost producer globally, with incredible scale in what is a highly consolidated industry. At the same time, I recognize that we take on certain risks when owning a company engaged in mineral extraction, especially in a country like Kazakhstan that can be politically unstable at times. That said, I believe that the recent change in government will do little to impact the operating environment in Kazakhstan, though the tax rate may expand moderately.

b. Newspaper Securities Basket (LEE Along with Other Positions Not Currently Disclosed)

Most global print newspapers have seen their readership decline for decades as subscribers seek out alternative digital sources of information. In response to this, newspapers have tried to build up their digital presence. Historically, this digital revenue stream was always rather negligible as it was coming from a small base, especially when compared to steep declines from the print side.

Over the past few years, digital revenue growth has accelerated to the point where I expect that the newspaper companies in our basket are within a few years of their digital revenue overtaking their print revenue—assuming recent trends hold. Digital revenue represents a higher margin and higher return on capital business when compared to the capital and manpower intensity of printing and distributing physical newspapers. My belief is that, as these digital businesses come to dominate the revenue stream, newspaper company valuations will re-rate—particularly as many of them trade as if they are dying businesses, when in reality, the digital side of their businesses is growing quite rapidly.

While many well-known global newspapers have successfully made this digital transition and seen earnings growth for a number of years, many smaller papers have continued to see earnings decline. I believe that these smaller papers are now on the cusp of an inflection to earnings growth as digital growth overtakes print declines. Should this happen, I anticipate it will dramatically change the narratives for these companies, along with their valuations, much like what occurred at more well known papers. The fund owns a global basket of these smaller newspaper companies.

Looking at LEE, which is our largest position in this basket; during the most recent reported quarter, LEE saw 65% annual growth in digital subscribers. Additionally digital revenue now represents approximately 34% of total revenue. Both of these metrics are rapidly growing. I have every reason to believe that this growth will continue in future periods.

c. St. Joe (JOE – USA)

JOE owns approximately 175,000 acres in the Florida Panhandle. It has been widely known that JOE traded for a tiny fraction of its liquidation value for years, but without a catalyst, it was always perceived to be “dead money.”

Over the past few years, the population of the Panhandle has hit a critical mass where the Panhandle now has a center of gravity that is attracting people who want to live in one of the prettiest places in the country, with zero state income taxes and few of the problems of large cities.

The oddity of the current disdain for so-called “value investments” is that many of them are growing quite fast. I believe that JOE will grow revenue at 30% to 50% each year for the foreseeable future, with earnings growing at a much faster clip. Meanwhile, I believe the shares trade at a single-digit multiple on Adjusted Funds from Operations (AFFO) looking out to 2024, while substantial asset value is tossed in for free.

Besides the valuation, growth, and high Return on Invested Capital (ROIC) of the business, why else do I like JOE? For starters, land tends to appreciate rapidly during periods of high inflation— particularly an inflationary period where interest rates are suppressed by the Federal Reserve. More importantly, I believe we are about to witness a massive population migration as people with means choose to flee big cities for somewhere peaceful.

I suspect that every convulsion of urban chaos and/or tax-the-rich scheming will launch JOE shares higher, and it will ultimately be seen as the way to “play” the stream of very wealthy refugees fleeing for somewhere better.

JOE was also featured in Weekly Ideas #19, with commentary in Nitor Capital’s 2022 Annual Letter.

d. Energy Services Basket (Positions Not Currently Disclosed)

In 2020 when oil traded below zero, drilling activity ground to a halt and many energy service providers declared bankruptcy. Many of these businesses had teetered on the verge of bankruptcy for years due to reduced demand and over-leveraged balance sheets. The bankruptcies led to consolidation and reduced future industry capacity, removing future competition in the recovery.

With oil prices now at multi-year highs, I believe that demand for drilling and other services will recover. We purchased many of these positions at fractions of the equipment’s replacement cost, despite restored balance sheets and positive operating cash flow. As the sector recovers, I believe that this cash flow will become more apparent, and this equipment will trade up to valuations closer to replacement cost

e. Long-Dated Oil Futures and Futures Options (Various Strikes and Maturities)

I believe that many years of reduced capital expenditures in the oil sector, combined with continued increases in global consumption, ought to lead to higher oil prices. We are expressing part of this bullish oil view by directly owning December 2025 oil futures, which trade at a substantial discount to front-month pricing. I believe that these futures will eventually reflect anticipated inflationary cost pressures and trade higher. Additionally, we own a sizable position in various longer-dated oil futures options as they give us additional upside leverage to this thesis, but with a defined risk profile should I be incorrect in my analysis. Given the long-dated nature of these futures options, the premiums should only decline gradually, giving us plenty of flexibility to re-evaluate this position over time, with minimal price risk.

(3) Palm Valley Capital: Good Enough?

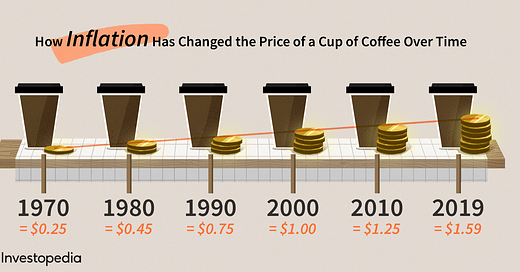

Based on our initial review of recent earnings reports and conference calls, we believe the Federal Reserve’s flexibility to backtrack on tightening will be limited by accelerating labor costs and strong corporate pricing power. Rising costs and pricing responses continue to be the main topic of discussion among business leaders.

In its effort to contain inflation, overstimulated demand, shortages, and an incredibly tight labor market, the Federal Reserve has relied on words over action. As a result, companies have been left to fight inflation on their own, implementing multiple price increases in 2021 and announcing additional increases in 2022.

With stocks down only slightly from their record highs, investors don’t appear overly concerned. The perception appears to be the fight against inflation will be brief and will soon reverse without penalty or sacrifice. And this, in our opinion, is the most crowded consensus view in the financial markets today. That after a shallow decline in asset prices, inflation will subside, the Fed will pivot, and investors will once again ride the Fed’s easy money wave to new market highs.

Based on the amount of inflation that has occurred and is in the pipeline, we believe the Federal Reserve has gotten inflation terribly wrong. For the Fed to regain credibility and achieve its price mandate, we believe a meaningful tightening in monetary policy or sharp decline in asset prices will be necessary. Although central bankers have certainly conditioned investors otherwise, whether they like it or not, we believe a large serving of vegetables is on the way. While most investors won’t like their taste, they are long overdue, healthy, and if positioned properly, can be delicious!

Tweets That Make You Go… Hmm 🤔

Job Opportunities 💼

Thought I would include job opportunities in this issue, since I came across a few on FinTwit.

1) Kuppy’s Praetorian’s Firm

2) Conversant Capital

3)

If you know of more opportunities, feel free to reach out and I can include it in future issues.